Key summary:

Change in interest rate has a strong effect in every sector of financial market including stocks, currencies, commodities, bonds, crypto…..etc. Normally, it is a major part of monetary policies. It is decided by central bank as a means to control inflation. So investors should keep a close eye on the policies of different central banks.

Bank of England is known as the originator of modern central bank systems, all central banks are established based upon the structure of Bank of England. Federal Reserve of US bears a nickname which is the central bank of central banks for all other central banks are targeting at their interest rate. Of course they would not follow it for 100%, but would keep in close observation as a major means of adjusting their own policies. The European Central Bank is the youngest major central bank of the world, and is considered as energetic and reformative, that even the US Fed would adjust according to their structure.

Normally, central banks would have their periodical report on current economic situation and outlook. They would use monetary policy to adjust the situation and bring it on the track. Monetary policy is the action that a country’s central bank or government can take to influence how much money flow should be in the economy and how much it costs to borrow. Interest rate the most common tool.

The central bank sets the interest rate that commercial banks need to borrow from them and they can adjust the rate lending to clients. This is the major tool to adjust inflation. When interest rate is lowered to zero, the other means is to buy bonds so as to release money outward. The latter is known as Quantitative Easing (QE) for ultimately the money run out to the society equals to lowering the interest rates on savings and loans.

Among the various forecasts in the market, interest rate normally is the most accurate one, for it is decided by a meeting. Those members of central bank make their decision according to the economic indicators announced and practical situation of the society. As for Wall Street analysts, they also watch the same group of figures. So if everyone in the market forecasts it would rise, it really would rise, it would not be too far away. But sometimes may be a little different in base points may be 25 or 50 base points different from forecasts. But if it is the stock index, the fluctuation is decided by free market, so not easy to grasp; even if a lot of analysts say it would rise, sometimes it would turn down because of numerous factors in the market and diverted the attention away, of having some special happenings. So as the announcement of economic indicators, market analysts sometimes cannot have so much data in hand as the Bureau of Statistics, therefore not so accurate.

Interest rate is used to facilitate or control the borrowing of money so as to bloom up or cool down the economy. When interest rate is lowered, that means the cost of borrowing is lowered also, thus encourage enterprise to borrow money to develop their business. They will take more ventures and thus can bring more job opportunities to the society and in turn bring more consumption which can bring about prosperity. On the other hand, when the economy is too hot, the central bank has to increase the interest rate, thus the cost of borrowing is higher, and encourages people to save more money in the bank and do not use money for venturing. Saving is encouraged. This is the standard response on rate changes.

However, in practical situation, there is a rate cycle. That is a series of rate increasing for several years and then kept unchanged on the top for a certain period. Then comes the rate decreasing for several years and kept unchanged on the bottom for a certain period. The central bank has regular meeting on rate decision and when in need they can call for extra meeting. But before the meeting, market has already known the current situation and from interview of the members, normally they can have a relevant forecast. Therefore, speculations often started several weeks ahead of the rate decision meeting, and when on announcement after the meeting, all speculation has already been done for the market is sensitive. Those who wish to buy or sell should have placed their order long ago, and would not be so stupid to wait until the announcement is made. Or maybe most of the orders had been done, and only leave a little to wait for official announcement. And if the interval is too long, counter reaction may be seen on announcement. That is if the market should rise thus become falling, if falling thus become rising. Simply because orders had been made long ago and there comes the time for harvest that is profit taking. So the fact is that if the market should rise, becomes falling, if the market should fall, becomes rising.

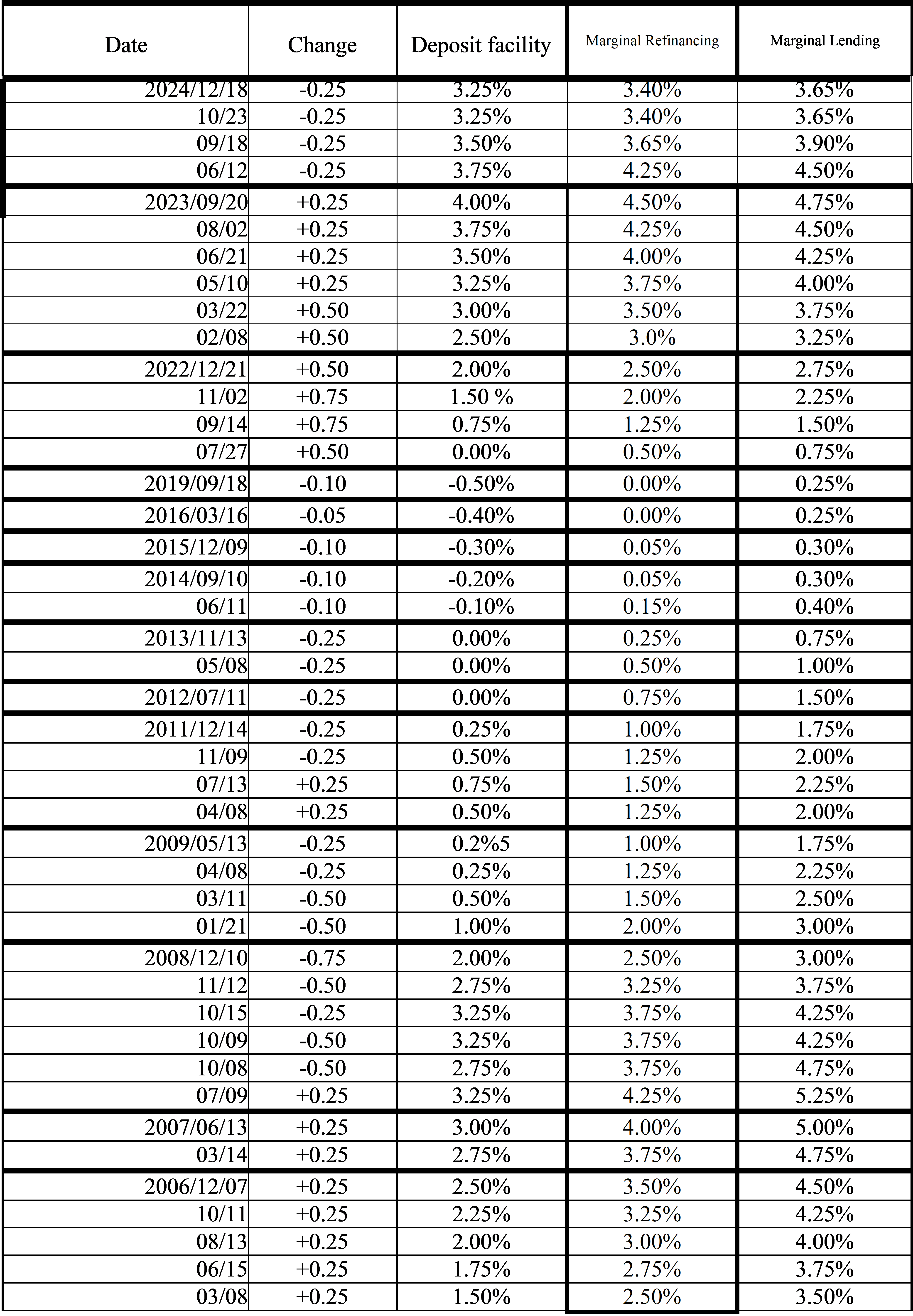

This is more prominent in the beginning of a cycle, no matter increasing or decreasing, for there is a long period of keeping rates at top or bottom, so the speculation is quite long indeed. Now let’s go through the recent interest cycles starting with the beginning of this century till now. Please refer to the interest rate tables of each central bank while reading, and also refer to the Economic Indicators of Allocution 9.

1) Bill Clinton took office in 1993, why he could win the presidency? It was because George Bush senior was concentrated on war and neglected economy. Bill Clinton is a strong man in economy, during his presidency from 1993 to 2000, Dow Jones turned from falling to rising, from 3,256 points to 10,587 points. Unemployment dropped from 7.3% to 4.2%. But unluckily, this cannot persist long. After he stepped down, George Bush Junior took office and the economic cycle ends, GDP started to drop from 4.6% to 1.3% in Q1. Economy entered into a deep valley.

2) The 9/11 terror attack was in Sep 2001, economy was already in a tough cycle then. Please refer to Business Cycle on the last item of Allocution 9. On the morning before the terror attack, the interest rate of US is 3.50%, which is in a low level when comparing with other banks. New Zealand 5.75%, Bank of England 5.00%, Australia 4.75%, European Central Bank 4.25%, Bank of Canada 3.75%, Bank of Japan 3.50%. All planes in US grounded for 3 days and no foreign planes can fly in, including domestic and international flights, the US market stop running for 4 days. Economy was greatly hurt. US have to lower the interest rate greatly but not zero.

The 9/11 attack accelerated the rate decreasing cycle, but war on terror attack soon started in early Oct against Afghanistan. It has great progress in the first months, that Taliban was defeated even though the war lasted for 20 years. Interest rate lowered from 3.50% to 1.75% of Dec 2001 and kept unchanged for 11 months. Economy rehabilitated quickly, since the whole world united together to fight against terrorism. Even though economy was hurt by terror attack, but it is controlled soon, thus had a feeling of an end of rainy days and henceforward sunny days are coming. However, gold started a long bull market for 10 years since then.

3) War on Iraq started in Mar 2003, but half a year before that George Bush started to say war was near every several days. Thus the whole world’s economy was hurt and need to decrease the interest rate to save it. The allied army used just 3 weeks to capture Baghdad, advancing from seaside of Persian Gulf to the capital Baghdad and major attack finished by the end of Apr. On May 1, George Bush gave his victory speech stating mission accomplished. But fighting carried on and the last soldier went home was shortly before Christmas of 2011. The last time of rate decreasing was in Jun 2003 and kept unchanged for one year. Rate increasing cycle started in Jun 2004. Dow Jones fell several months before war started and gold rose. Before the war, the whole world was in gloomy, people worried words that threatening war would come every day, the economy will collapse even more. For every day seemed to be the last day, but actually the next day was the same also the last day again. On day of breaking out, everything turned vice versa. Stock market rose up greatly and gold fell greatly for all bad news are gone, and no more bad news will come. People were waiting for the victory of US to come shortly. This is one the most famous counter response of the market.

4) Dow Jones continues to rise, and made record high in Feb 2004, but no major retreat and continues to move in high level. Economy continued to grow heat that rate increase cycle had to start in Jun 2004 and lasted for two year until Jun 2006. It kept unchanged for more than a year until Sep 2007. So what happened at this period?

5) The nuclear crisis of North Korea started in Oct 2006, the Subprime Mortgage crisis started in early 2007. Petroleum crisis also started its rising wave because of economic bloom and worry the consumption will be greater and greater. North Korea nuclear crisis was also a catalyst. The rise in petroleum price made the subprime mortgage more serious. Thus hurt the economy even deeper.

6) Rate decreasing cycle started in Jul 2007 and this is also one typical example of reverse trading. Normally, decrease in interest rate is to encourage people take out their money for venture, including using margin to trade in financial market, for the borrowing cost is lower. A decrease of interest rate is beneficial to the market. And starting of a decreasing cycle should be more beneficial to the stock market and a long term decreasing is ahead and the market should be considered to have a bright future. However, the Dow Jones started a downward trend in Oct 2007. Why?

Decrease in interest rate denotes the economy is tough and in a weak state. For problems of nuclear crisis, subprime mortgage and high energy shortage cannot be solved; even Strategic Oil Reserve released still could not press down the price. Why there is a need in rate decrease? It shows the economy is weak. Please refer the above incidents to various table of interest rate and thus can detect a lot of undermined reasons.

Basically, higher interest rate is used to attract saving, so as to cool down the economy, and lower interest rate is used to encourage venture. In terms of saving, please refer to the table of various interest rates of different central banks. When the interest rate of UK and Canada is higher, actually people can make deposit in them by offshore saving accounts. That is they need not fly to that country, they can open a foreign currency account in their own place and thus can earn that interest rate. But this is not a secret, everyone can refer to this table, does it means all capitals of the world will flow to UK and Canada only? EU and Japan are in zero interest rate, why don’t those people withdraw all money and put into UK and Canada? So UK and Canada will be flooded by money? And EU and Japan will be dried up?

It is because of exchange rate. Theoretically, when the interest rate of a country is higher, it can absorb foreign savings, and the exchange rate should be firmer. But it is only one of the reasons of going firm; still have to decide on the total economy of the country. Why countries need to increase interest rate to absorb foreign capital? Sometimes, it denotes their currency is weak or falling, so people dare not to put their money to that country even if the interest rate is higher. They afraid the exchange rate will fall further so even if the interest is higher still cannot cover the loss. And if the interest rate is low, that means the economy is booming, there are a lot of ventures, the prospect is quite good, for when economy is in prosperity the currency normally will go stronger. So even if the interest rate is low or zero, the rise in currency rate can cover the low difference in interest rate.

Therefore, even if the interest rate of a certain country is higher than other, people would not simply put their savings to that country. And even if the interest rate is lower, still can attract a lot of capital coming when the outlook is positive. Economic growth and political stability will be over the interest rate.

So we carry on to the Financial Tsunami (Great Recession) of 2008. It was aroused by the subprime mortgage, but before that the petroleum price already rocketed up to $147 and brought about a recession. At length it was triggered by the bankruptcy of Lehman Brothers in Sep 2008. At that time the Fed rate was already in a decreasing cycle from 5.25% to 2.00%. The room for decreasing actually is not so much, but still has to face it. There is a significant change in Dec 2008, not only the interest rate met with zero, but also have flexible rate within a range of 25 base points.

On 30th Apr 2008, the interest rate is fixed to 2.00% and carry on decreasing, until 29th Oct 2008 the interest rate is lowered to 1.00%, but on 16th Dec 2008 the decrease of interest rate has changed from a fixed range to a flexible range of 25 base points that is the decrease is 75 – 100 base points, so the new interest rate is 0.00% – 0.25%. Thus have a range of 25 base points and not as before fixed at a certain level. That means the central bank can release the capital according to each individual case at the interest rate from 0.00% – 0.25%. So the bank also can release to each individual client or even the same client but individual case at any level within the range of 0.00% – 0.25% and not just a fixed level as before. This policy is used until nowadays and is still using. Please compare with other central banks and thus can have a broader view.

This zero or near zero interest rate is used until Dec 2015, the economy had a total recovery. What happened in 2015? Shale oil of US is successfully developed. Thus US become the largest oil exporter surpassed Saudi and Russia. So the petroleum crisis of the world since 1973 ended.

The followings are tables of different central bank rates and have been keeping updated for over 30 years. It show the cross relationship of different central banks in different areas. There is also a brief description on the structure of these banks. Whenever it has any changes, they will be published in The US Stock Express; however, it’s better for investors to keep them updated all the times, as the treasure and knowledge would belong to the readers. Sometimes, people may ask why some other people are so smart in analysis and forecasting. The prerequisite is that one must have abundant data in order to do so. When the data is limited, the scope of analysis surely is limited, but when data is more, obviously the analysis will be wider and deeper than others.

Major Central Bank Rates

| Country | Rate | Change | Date |

| US | 4.25-4.50% | -0.25 | 19.12.2024 |

| EU | 3.00% | -0.25 | 18.12.2024 |

| Japan | 0.25% | +0.15 | 01.08.2024 |

| UK | 4.75% | -0.25 | 08.11.2024 |

| Australia | 4.35% | +0.25 | 07.11.2023 |

| NZ | 5.25% | -0.25 | 14.08.2024 |

| Canada | 3.25% | -0.50 | 11.12.2024 |

Interest Rate changes normally come to effect the following day after announcement, but European Central Bank is one week after announcement. This table shows the effective day and not announcement date.

i. Function and structure

The Federal Reserve is established in 1913, it is upgraded from First Bank of United States to be a de facto central bank even it do not use such a term. It carries out the major function of a central bank which is the bank of banks. The US Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. To achieve these aims, the financial market aims at the fixing of interest rates, but when the interest rates are fallen to zero, the effective tool is the printing of money to buy bonds and is called Quantitative Easing, while for other times, the printing of banknotes is neglected by the market.

What the market mind most is the Federal Open Market Committee (FOMC) meetings, for it decides the interest rate and this affects the market most among the whole structure of the Federal Reserve. The Federal Reserve controls the three tools of monetary policy—-open market operations, the discount rate, and reserve requirements.

The FOMC has 8 meetings a year with an interval around 6 weeks. After the meeting, the Statement is the most important release of forecasting the future no matter it has change in interest rate or not. Normally, the Statement is around 300 words, and when cutting off the prelude and postlude, the core is just about 200 words. But it always make the market goes up and down vigorously. However, their culture is to keep neutral and would not say firmly what would happen next, for there are so many variants in the future, that sometimes their forecast may not come true for they afraid thus will be complained. Until Mar 2022, Powell after rate increased, firmly said there will be 6 more times of rate increase at least 25 base points each time. Never this had been done of pre-announcing the increase of next 6 meetings. It was believed that the poll of Joe Biden was quite low and have to control inflation before the Congress election of Nov 2022.

The Federal Open Market Committee (FOMC) consists of twelve members—-the seven members of the Board of Governors of the Federal Reserve System; the President of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank Presidents, who serve one-year terms on a rotating basis. So they are divided into members and alternate members like the following.

2022 Committee Members

Alternate Members

Federal Reserve Bank Rotation on the FOMC

Committee membership changes at the first regularly scheduled meeting of the year

| 2023 | 2024 | 2025 | |

| Members | New York Chicago Philadelphia Dallas Minneapolis | New York Cleveland Richmond Atlanta San Francisco | New York Chicago Boston St. Louis Kansas City |

| Alternate Members | New York† Cleveland Richmond Atlanta San Francisco | New York† Chicago Boston St. Louis Kansas City | New York† Cleveland Philadelphia Dallas Minneapolis |

†For the Federal Reserve Bank of New York, the First Vice President is the alternate for the President

So when investors read on the news that the President of this and that Fed Chair gives his speech and opinion on interest rate, be sure to know whether he has the right to cast a vote in the FOMC meeting. Only 12 people has the right to cast a vote, and when in deadlock the Chairman will has the right to cast the last vote.

ii. Independence

The Federal Reserve is famous for independent monetary policy and would not be affected by anyone else including the President. That is no one should interfere them. As for appointment, normally the cabinet leader is appointed by the government, and his subsidiary appointed only by him and not President. The Federal Reserve is under that Treasury Department, so it is normal for the Treasurer appointed by President, and those that underneath the Treasurer is from another level, all such levels from the cabinet should have no relation with the President. But there is an exception, the Chairman of Federal Reserve is appointed by the President and not only this, even the vice-Chairman is also appointed by the President, so it’s a little surprising. However, for the inauguration ceremony, the Chairman needs to swear to the President and the vice Chair only swear to the Chairman and no need to the President. Anyway it shows their position is different from other subsidiaries. They are in a special location after all.

The term of the Chairman is 5 years, which is longer than the President of 4 years so that he can carry on his policy even the President changed. The longest term held is William Martin held for 18 year 10 months from 1951 to 1970 and the second is Alan Greenspan who serves from 1987 to 2006 for 18 years 5 months. When the President is not satisfied with the performance of the Chair, he can appoint a vice-Chair which is of opposition policy direction to make it balance.

iii. Issue of currency

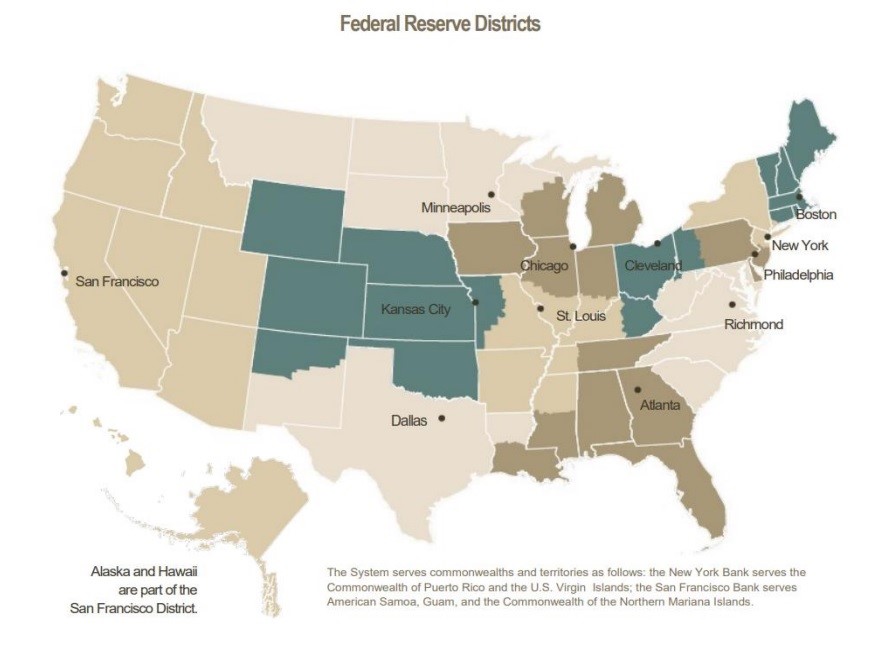

The Federal Reserve is also responsible for issuing of bank notes, but few people would realize that the US dollar is issued by 12 different banks of Federal Reserve. The Federal Reserve divides the whole country into 12 districts, each district has its own reserve bank issuing their bank notes, it can be seen in the left hand side round seal as followings:

The US dollar bank note normally after using for 18 months will be re-cycled and destroyed, so the bank notes you see basically are quite new.

Twelve District of Federal Reserve

iv. Other contacts

a. Beige Book

Besides the Statement of FOMC, the Federal Reserve also has other means of communication with the outer world. The most famous one is the Beige Book. It is released 8 times a year. It is a survey and not a comment from the officials. The whole country is divided into 12 regions as in the above chart and the survey is done to understand the changes in each district. Each report consists about 30 pages so that it is quite comprehensive, but normally released with a summary of 2 pages. It is normally released in between the two FOMC meetings and is considered as the most authentic report on current economic situation of US.

b. Minutes

It is released 3 weeks after the FOMC meeting, normally let the general public know what’s happening in the rate decision meeting. Such as how many members cast vote for consent and objection, how many members express their wish of changing the rate by 25 points or 50 points. It is regarded as a means to track and trace the dovish power or hawkish power domains the committee, so as to see those people that gave speech in advance can or cannot persist till the end.

c. Press conference

Originally, the Federal Reserve has no press conference. But when the European Central Bank was established in 1999, every time they have press conference after their rate decision meeting and the Chair would come out to answer questions. The response was quite nice and well praised. Since 2010s, the Fed introduced their press conference, at first only alternatively, and now there is press conference after every meeting. This shows Federal Reserve is willing to learn from the younger generation of European Central Bank so as to keep them updated to the latest trend of the world and has no sense of arrogance at all.

d. Economic Outlook

There are 4 reports Economic Outlook releasing every year, it is publicized in the Press Conference. It shows their forecast on the economic development of US, but without touching the point of interest rate. So Beige Book is talking about the past, and this Outlook is concerning the future. In the Press Conference, it comes out alternatively, that is one without the Outlook and the other would have it.

v. Annual Meeting

Theoretically, the Federal Reserve does not have an annual meeting. It is a nickname used by media to describe the meeting held in Aug in Jackson Hole Resort of Yellow Stone Park. It is managed by the Kansas Fed and not by Head Office. But they invite the Fed Chair to come and also one or two central bank governors of other countries. Every year the list of guests will vary. It is famous because Ben Bernanke announced his famous QE2 policy in the meeting of 2012 and made the world realized that besides the FOMC meeting, there is still another important meeting every year. Some people even call it meeting of world central bank governors. It is famous because that year there is a famous Hollywood movie known as “2012”, where it describes the end of the world generated from the Yellow Stone Park.

vi. Chair & G7 meeting

The Chair of Federal Reserve will attend the G7 meeting of Finance Ministers & Central Bank Governors annually and also the meeting of IMF and World Bank twice a year so as to show their responsibilities to the world.

Janet Yellen took office in 2014, at that time the term Chairman was changed to Chair in order to shorten the appellation, for Chairwoman sometimes is too clumsy and would have sexual discrimination. The writer wants to tell what had happened in 2014. Everyone in the world, no matter from east or west would say she is the first female Chair of Federal Reserve, the writer would say it is not absolutely correct even if it is not wrong. It is a debased description.

It should be described as Janet Yellen is the first female Chair of four major central banks of the world including Bank of England, European Central Bank, Bank of Japan and Federal Reserve. When investor wants to win and win, better have a bird eye’s view over everything even if the eye on the ground is still correct.

So let’s study the rate cycle of US Federal Reserve one by one, and please update further the following table on your own.

The Federal Reserve Board

i. Structure

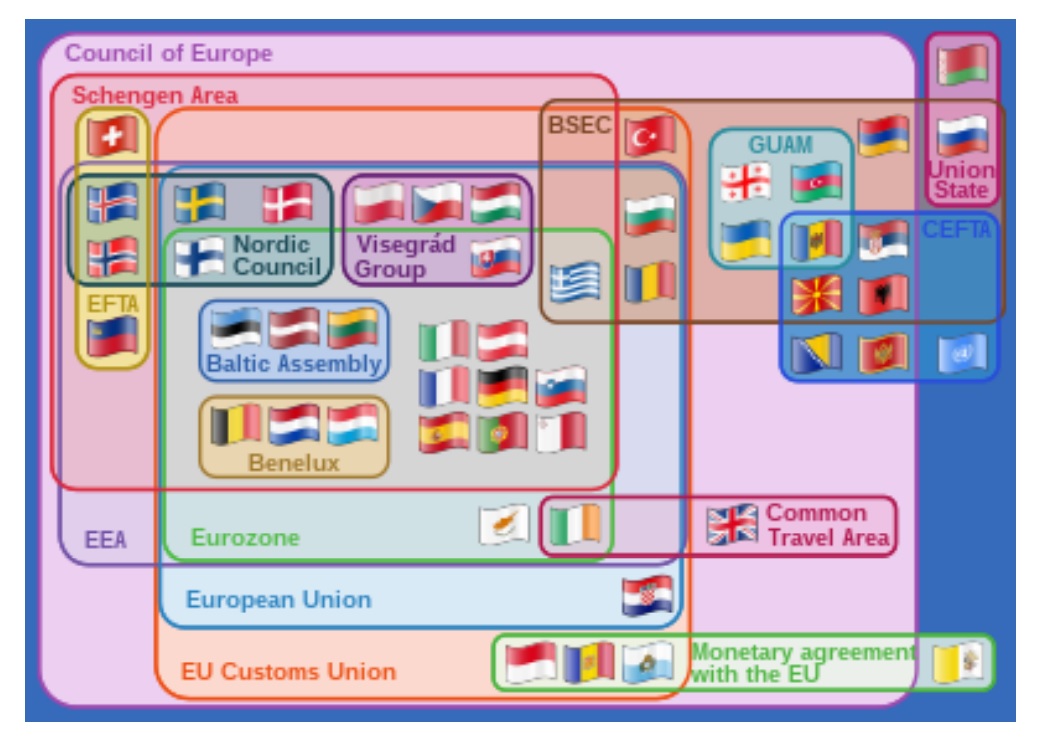

This is apparently the youngest major central bank of the world. The most important task of the bank is to launch out the first Single Currency of the world which is Euro in 1999. At first the Eurozone has 11 members and now 19 members: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. It is shown in the following chart.

During the first few months of birth of Euro, it drops greatly and the Central Bank disclosed that the major task of the bank is not to keep the exchange rate high, but just to keep the currency to go up and down in a well order and do not arouse panic.

This central bank is different from others, all other central banks are under their treasury department, but the European Union does not have a Treasury Department, therefore sometimes it has to take up its task, but their power is unable to do so. The problem is that the bank has a uniform expenditure, but they do not have a uniform income, they have no right to collect tax from member countries. However, what the market mind most is still their interest rate decision. Investors must also understand the structure of different European organizations as in the following chart.

Now actually, a lot of countries are using Euro besides the Eurozone. In Balkan Peninsulas they do not use the currency of their countries due to high inflation, instead people like to use Euro. A lot of candidate that wish to join the EU, people would also keep Euro as a currency. In the UK, some shops stick a label of Euro accepted just wish to attract more clients when facing keen competition even they know their only legal currency is British Pound. In North Korea, they treat US as enemy so they do not accept US Dollar and only accept Euro. Therefore, Euro has already step out of Eurozone, and the goal behind launching of Euro is to replace US Dollar as an international currency and to some extent they succeeded.

ii. Rate Decision

The rate decision in European Central Bank is unique in the world. They do not use the method of casting votes. Instead the Chair would discuss with the President of central bank from each country to decide.

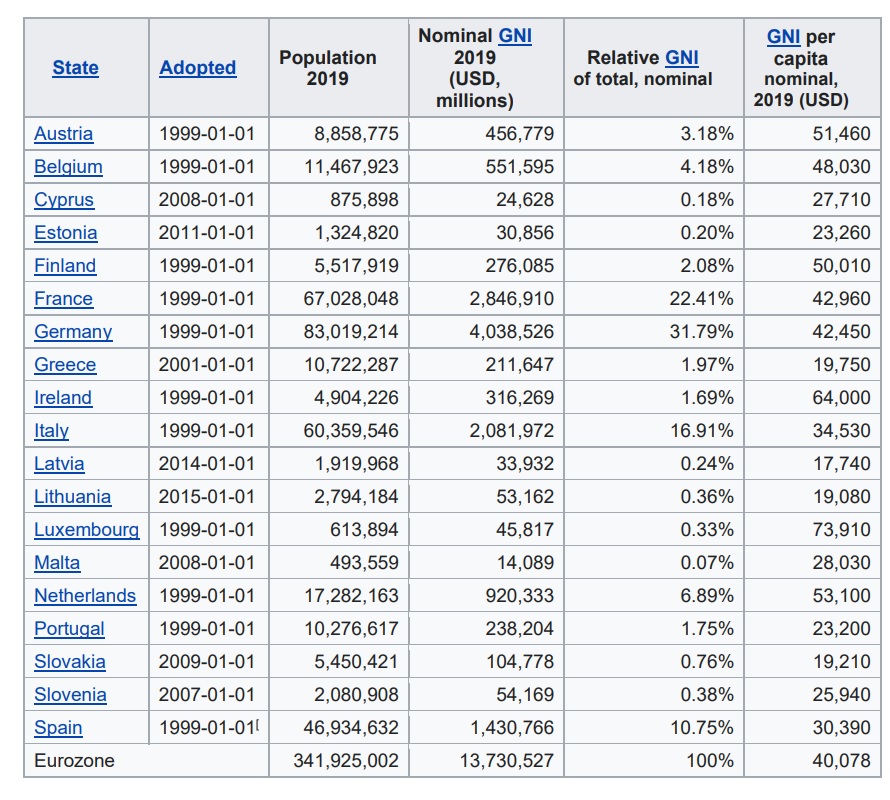

Since Euro is the single currency of 19 countries, their importance is decide by the Gross National Income (GNI) according to the following table. We can see that Eurozone has 4 strong powers which are of two digits; they are Germany 31.79%, France 22.41%, Italy 16.91% and Spain 10.75%. And when we go further inside, we can see that Germany and France already got 54.2%. Therefore nearly all diplomatic negotiations are using the Germany Chancellor and French President as representative.

But there is a problem, for small countries, they would have no chance to speak and only has the responsibility to pay off money according to decision of those powers. Is it fair enough? What is democracy? Besides following the majority also have to care for minority. This is true democracy and human right.

So for rate decision, it is unfair to let every country have a single vote, it is impossible to divide into 19 plain votes. For one vote of a small country should not equal to large country no matter in population, area or GDP….etc. However, if it is decided according to the above ratio of GNI, that means Germany and France already has 54.2% votes, then other countries no need to attend the meeting and no chance to give their opinions. So how to solve such a problem?

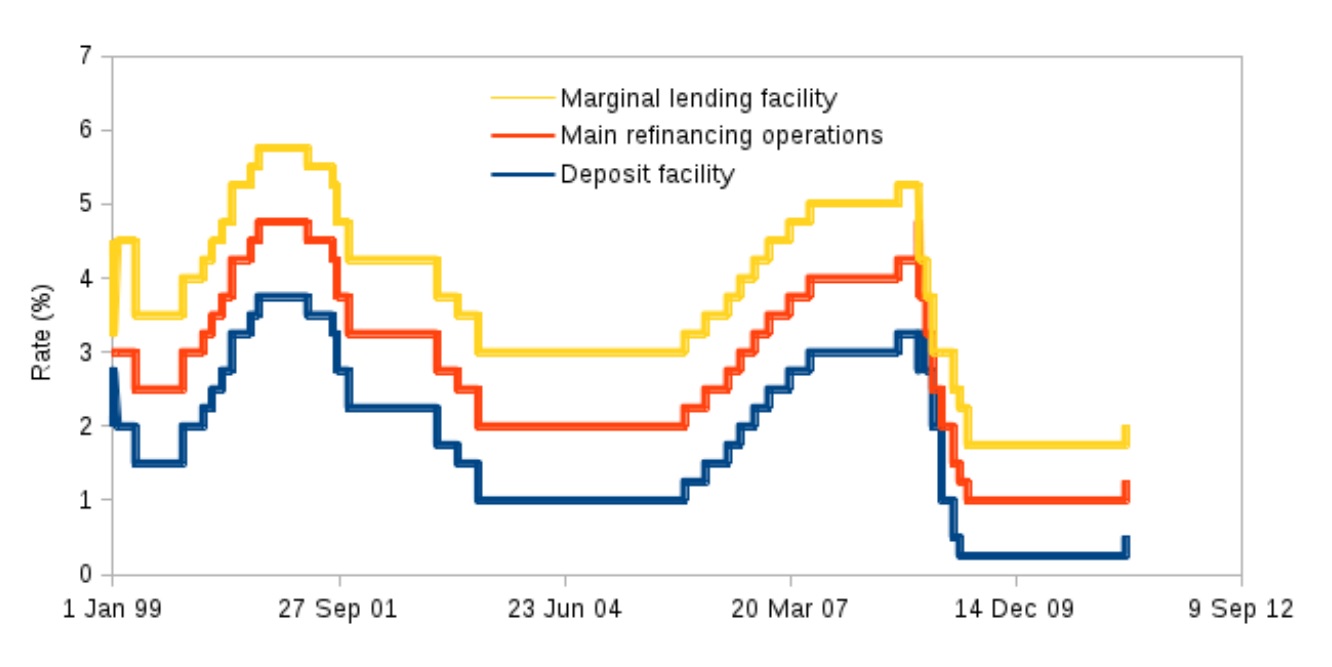

In every rate decision meeting, the Chair would ask each individual central bank President to express whether they would like to change the rate or kept unchanged and give their reasons. The Chair would mark down whether his reasons are full or feasible, and give an acceptance or objection mark. After going through all members, he would count how many countries will pass the change according to majority. If members are not satisfied with the decisions or performance of the Chair, they can request for changing another people to be the Chair, but the decision he passed must be carried out. Surely, this is not the best method, but before they can work out a better issue, they are still using such a style now. Following is the interest rate of European Central Bank, the highlight column is what investors can see from media.

European Central Bank Rate

a. The shaded column is Main Refinancing Operation (MRO) rate, it defines the cost at which banks can borrow from the central bank for a period of one week. If banks need money overnight, they can borrow from the marginal lending facility at a higher rate. Normally, in news reporting, they report the MRO only.

b. Basically, Marginal Refinancing Operation and Marginal Lending Rate should have a difference of 50 base points.

c. Marginal Lending Rate is also known as base rate.

d. The change of rate will be effective on the following day.

European Central Bank Rate

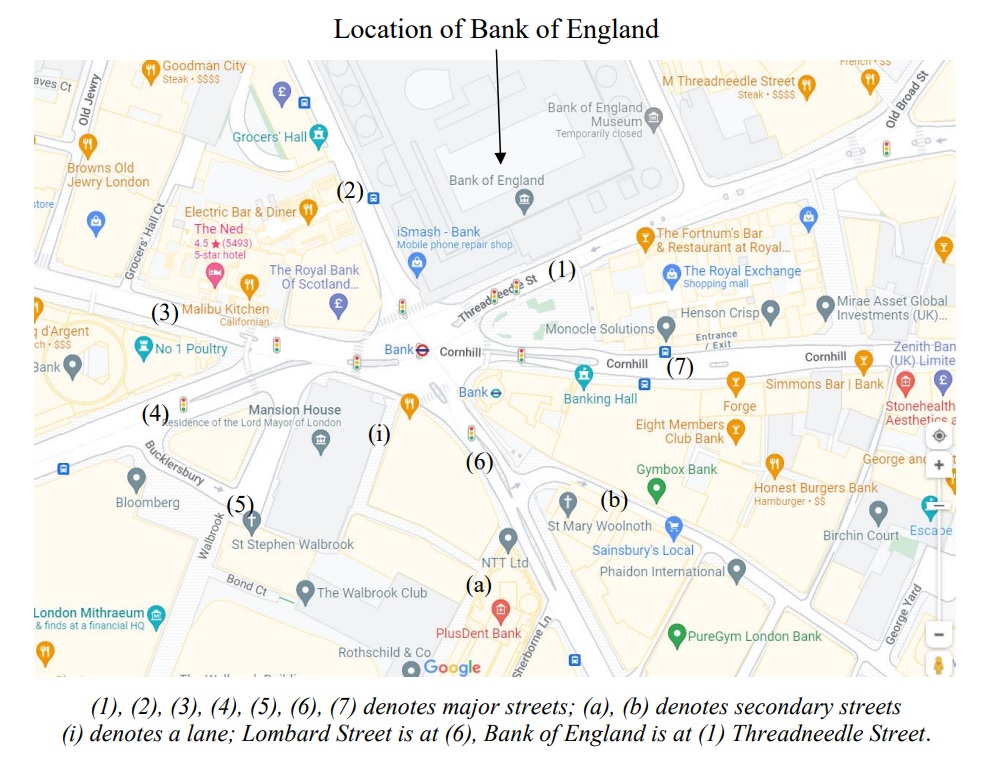

Bank of England is the originator of modern central bank system. That is the concept of central bank comes from Bank of England. It’s the government’s banker and also bank of banks. However, it is not the only bank that issue currency. The Scottish, Welsh and Northern Ireland central banks also issue their pound but can only use in their district only, while the pound issued by Bank of England can use through the UK and aboard.

The Bank of England is situated in the financial center of London, rather likely, the financial center of London is based upon Bank of England as a center. Seven major streets and two secondary streets and one lane form the financial center of London merge together as a junction of ten. One of the major streets is called Lombard Street, and it equals to Wall Street of New York. There is a rate in mortgage known as Lombard rate. Finance people in the UK is also known as Lombard. The underground station in that area is called BANK, therefore that area sometimes is called The Bank. Why this area is important? Because the Romans first landed London is here. They just want to keep away from the tide of River Thames, so they walked in several hundred yards away from river side and this small district of 9 streets is known as City of London, it also has its Mayor now, even the London Wall is dismantled. But this Mayor is different from the Mayor of Greater London Area, Boris Johnson before acting as Prime Minister of UK, he was the Mayor of Greater London Area and not just the financial center known as City of London.

The Bank of England is situated at Threadneedle Street and thus bear a nickname of Old Lady, gradually; the term Old Lady is used to describe a lady of well management in home affairs especially concerning money. Later on, when a woman can manage money in a well manner is also called Old Lady, it is a term of respectfulness.

Bank of England is an entity of low key, that its building does not have a large brand name, so before the introduction of GPS and Google map, a lot of tourists even stand in front of the building does not know where it is or the British people think that every civilized people and finance people should recognize it so no need to put a name over there.

Actually, the development of the city using the central bank as the center is so rare but it is the originator and some other newly developed cities are using such a design for reference, of Bank of England is far more than expected.

It’s the oldest central bank, but can accept new and latest ideas, the Governor is appointed by the cabinet and then approve by the Prime Minister and the Queen. The term of a governor is 8 years. In 2013, the Chancellor of the Exchequer (Financial Secretary) assigned Mark Carney, on finishing his term of Chair of Central Bank of Canada to be the Governor of Bank of England. It’s the first time during the 318 year history of Bank of England to assign a foreigner as Governor, and again the first foreigner in four major central banks of the world. At that time the Prime Minster was David Cameron. It was due to his nice performance in the Financial Tsunami of 2008, that no Canadian bank needs to ask help from aboard.

Another famous incident of Bank of England is the Black Wednesday, in 1992 George Soros, the speculator had short selling of British Pound for 10 Billion, G7 central banks united together still could not stop him, at last Bank of England had to withdraw from the European Exchange Rate Mechanism (ERM) and this made the birth of single currency Euro come earlier. When G7 central banks united together to interfere the market, they are invincible, but only defeated once, that is on Black Wednesday.

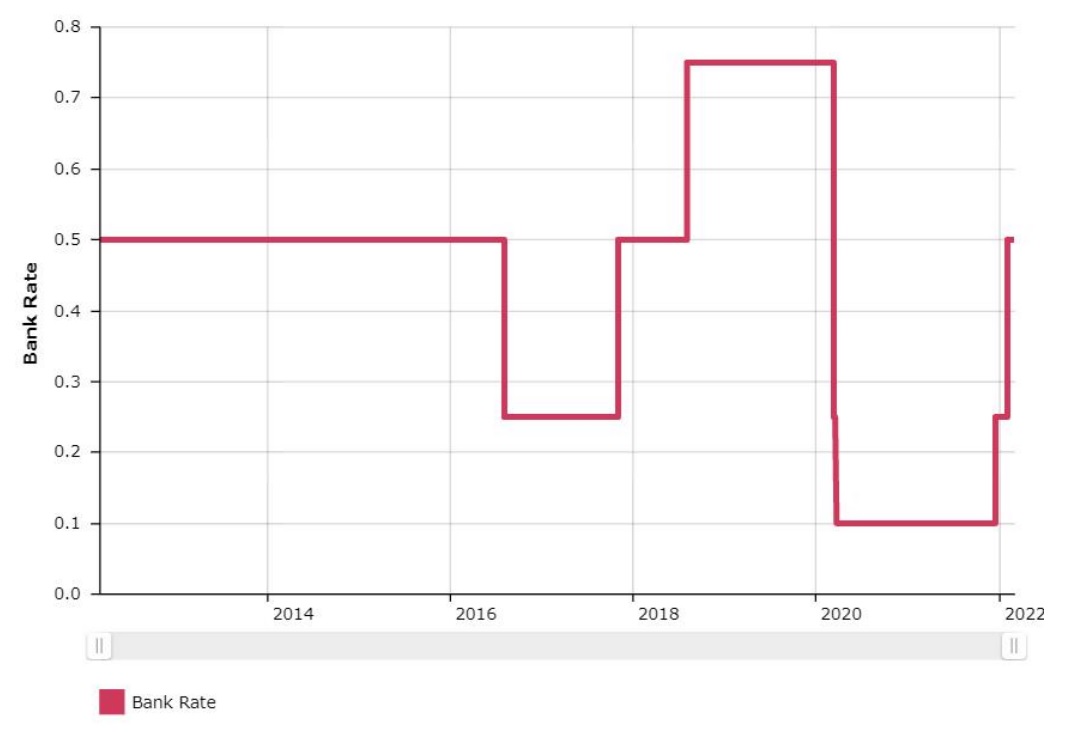

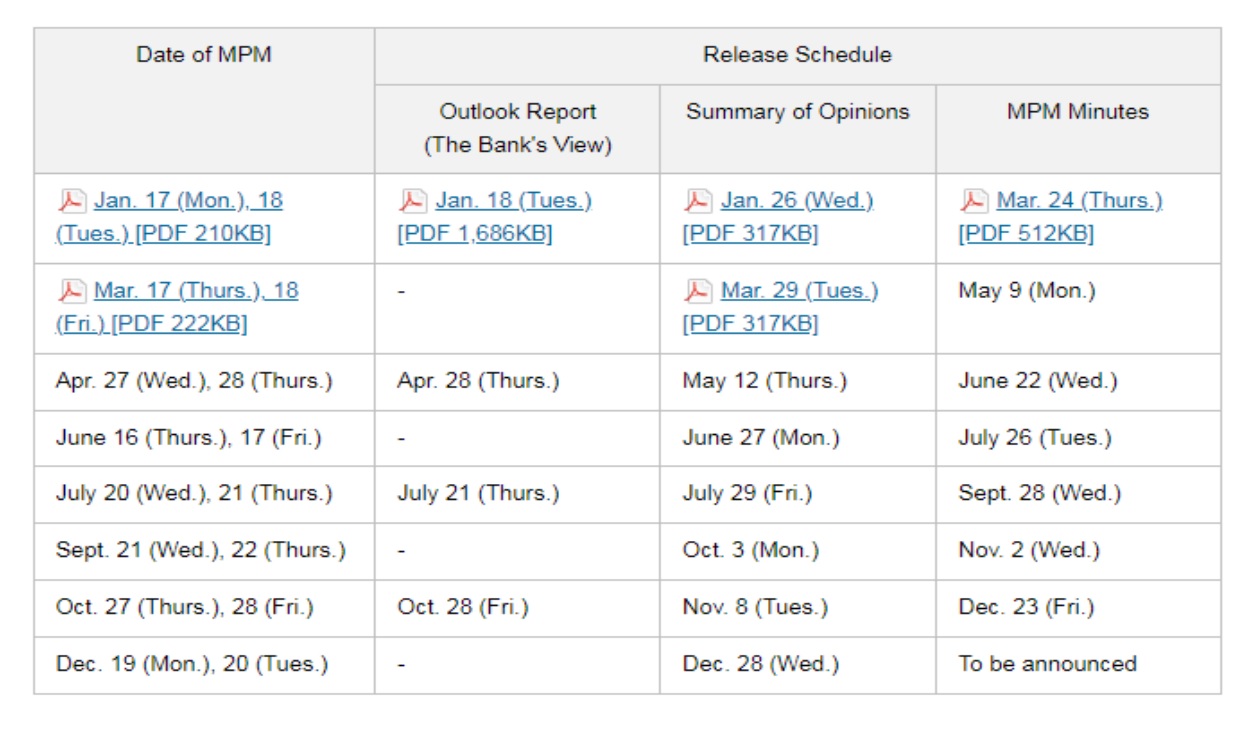

Rate decision is done by the Monetary Policy Committee (MPC) meetings, 8 times a year. They also have their report, once known as Inflation Report, and now Monetary Policy Report is released 4 times a year and also known as Quarterly Report. The Bank of England set an inflation target at 2% and now all other central banks try to fix their inflation rate at 2%, which is the healthiest inflation. When there is no inflation, that means price cannot go up and workers will never have increase in salary, but too high an inflation mean the depreciation of money. Therefore now all central banks are fixed to maintain their inflation target at 2% and when over or under it should have monetary policy to adjust it.

The Bank of England Rate

Dates for Monetary Policy Committee (MPC) announcements on Bank Rate and publication of MPC meeting minutes and the quarterly Monetary Policy Report.

Bank of England Rate

Bank of Japan is an independent bank out of the structure of Japanese government. It was found in Meiji Restoration but re-organized after World War II.

The rise and fall of interest rate react greatly to US during the presidency of Richard Nixon and Ronald Reagan. After the Plaza Accord of 1985, it became the central bank that interferes the market most, especially in 1990s. From 2003 to 2004, Japanese government did exchange intervention operation in huge amount, and the economy recovered a lot.

In Mar 2006, Bank of Japan finished quantitative easing, and finished the zero-interest-rate policy in Jun and raised to 0.25%.In 2016 it impose negative interest rate. The interest rate table is as following.

Bank of Japan Rate

Bank of Japan owns 5% of the Tokyo Stock Exchange and now is the largest owner of Japanese stocks. They follow the Federal Reserve to have 8 meetings of rate decision a year, and the report follows Bank of England to release 4 times a year as in the following table.

Mind that there are two banks that the names are quite similar, that is the “Royal Bank of Canada” is just a commercial bank, do not be misled by the term Royal, it has nothing to do with the government. The central bank is simply called “Bank of Canada”.

The Bank of Canada is the sole bank that issues money in the country, once it issued the $1,000 dollar bank note and was considered as the highest value of bank note in the world. But in May 2020, at the request of the Royal Canadian Mounted Police as part of a program to reduce organized crime, they stopped printing it and let them fade out naturally. At the time, 2,827,702 of the $1000 bills were in circulation; by 2011, fewer than 1 million were in circulation, most held by organized crime.

Since 2018, this bank note will no longer be a legal tender. Now the official Head of State is still Queen Elizabeth II, so all bank notes bear her portrait.

The Bank of Canada stated that they will refer to the US interest rate tightly since the inter-relation is quite close between these two countries, but would not follow completely. Actually, in every governmental department of Canada, they face the same problem. That is if they do not follow the US policy closely, will be complained of impractical since they are geographically, culturally quite close in every seen and unseen aspect. But when followed so closely will be complained of no independent policy and just say they want to turn the country to “little America”.

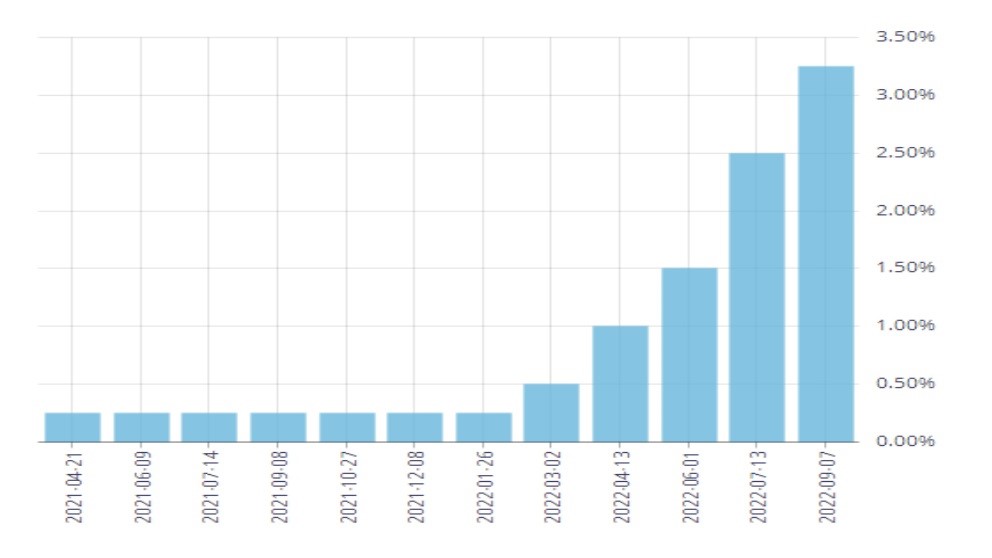

Bank of Canada follows Bank of England to have 8 rate decision meetings a year and 4 report annually. Following is the interest rate table.

Bank of Canada

Interest rate of Bank of Canada

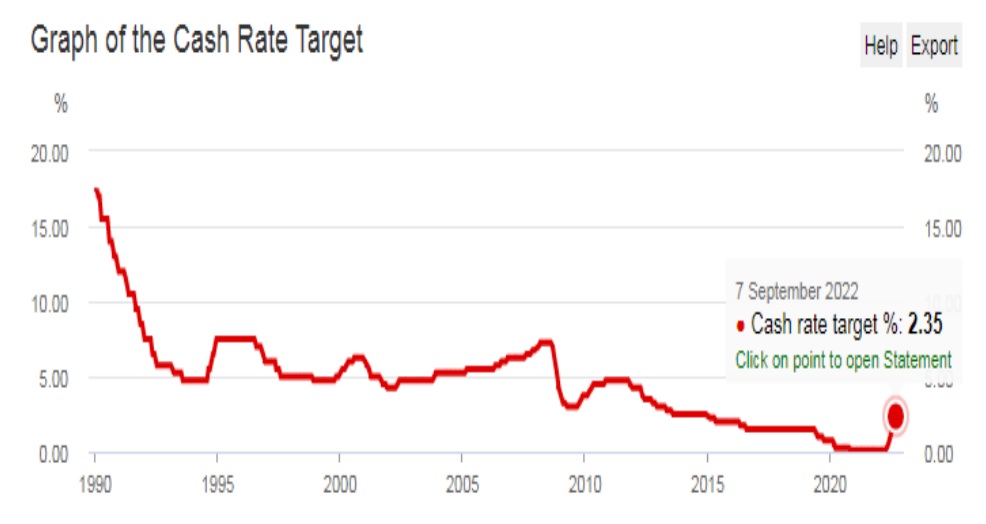

Australia and New Zealand are both at the far end of the earth, therefore for currency reserve both of them hold a certain amount of the opposite, besides USD and Euro. Thus their interest rate is always inter-related. Both of them traditionally are considered as high rate areas since 1990s. Their interest rate is known as Official Cast Rate (OCR).

Basically, they have 11 rate decision meetings a year and 4 quarterly reports annually. Once Australian dollar was in same track with British Pound using Gold Standard System, but in 1925, because of depreciation, it was de-tracked with British Pound. The current central bank was established in 1960.

In 2000 Sydney Olympics, the Australian dollar fell greatly, and at first hoped the event can push it up because of a lot of tourists, on the 3rd day of Olympic Games, it still have no chance to stop falling, so the G7 central bank entered the market to buy it up from 0.48 and until now had not met with that low point.

Reserve Bank of Australia (OCR)

https://www.savings.com.au/current-interest-rates-australia/

Basically, the bank only has 7 meetings a year, but sometimes would increase to 8 or 9. They also have press conference and Statement after the meetings. Recently, it interest rate is much higher than Australia due to the control of inflation.

Reserve Bank of New Zealand(OCR)

Interest rate affects the financial market to a great extent, but under the globalization of nowadays just keep an eye on a single country is absolutely not enough and must have a bird eye’s view all over the world.