Key summary:

These terms are for beginners looking to get into finance as well as students in Business College to understand how financial markets operate and comprehend how the news of North, East, West and South affects them.

This is when a stock has had a strong period of gains and then suddenly drops by 10% – it is known as an adjustment or sometimes a correction. It’s quite typical that when a market goes up too far, investors may wait for an adjustment to digest, this is because investors who have previously bought the product have to make profit and this therefore makes the price drop. Normally this is a nice time for investor to buy if previously they haven’t. A healthy market needs adjustment every now and then. Please look at the meaning of Rebound of opposition.

This is sometimes known as Post Trading Hours or Extended Hours. The following is the trading hours of the NASDAQ. Because of globalization, besides the Core Trading Session, investors can trade earlier which is known as Opening Session, or Pre-Trading Hours and can also trade after the Core Trading Session, also known as Post Trading Hours, Extended Hours or After Trading Hours as shown underneath.

Monday – Friday:

4:00 a.m. – 9:30 a.m. – Opening Session

9:30 a.m. – 4:00 p.m. – Core Trading Session

4:00 p.m. – 8:00 p.m. – Extented Hours

However, in the NYSE, the trading hours are as follows:

NYCETape A Pre-Opening Session 6:30 a.m. ET

Core Trading Session: 9:30 a.m. to 4:00 p.m. ET

TAPE B & C Pre-Opening Session 6:30 a.m. ET

Early Trading Session: 7:00 a.m. to 9:30 a.m. ET Core Trading Session: 9:30 a.m. to 4:00 p.m. ET Late Trading Session: 4:00 p.m. to 8:00 p.m. ET | NYCE ChicagoPre-Opening Session 6:30 a.m.

Early Trading Session: 7:00 a.m. to 9:30 a.m. ET Core Trading Session: 9:30 a.m. to 4:00 p.m. ET Late Trading Session: 4:00 p.m. to 8:00 p.m. ET |

From the above tables it can be seen that both the NYSE and NASDAQ have the same core trading session. Extended trading is the trading conducted by the network either before or after the regular trading hours of the listing exchanges. Such trading tends to be limited in volume compared to regular trading hours when the exchange is open. It gives a chance for investors to react to news even when a market is closed, however the risk is relatively higher due to the volume being less. In some rarer cases, the price has soared up extremely high in post market trading and dropped back to its original price closer to the market opening again. So even if trading occurs, investors often don’t trade large volumes. For stocks of NYSE, the classification of Types A,B,C can be seen in the following website.

Pillar_Migration_Plan.pdf (nyse.com)

The basic premise of Extended Trading hours is actually for transactions to be done outside of the Exchange House by electronic trading and therefore there’s no need to go through the exchange house physically but still be under their management and supervision. They just gather all the buyers and their prices and match with sellers’ prices to make the transaction. All trading is recognized by the exchange house as a normal trading within the Core Session. Because of this risk it is not so suitable for beginners.

This is the investment method of buying in and selling out different products at the same time or in different markets such as stocks, currencies, indices, commodities, bonds or derivatives in order to take profit from the difference. No one can entirely predict which direction the market will go, therefore, in order to avoid entering the market in the wrong direction, the best way is to buy and sell at the same time, so even if one side is in the wrong direction, the other side can cover it. In such a case, the trading amount must be larger than usual and thus may not be suitable for individual investors. Some investors have therefore chosen to establish a fund in order to collect more capital for trading. These are known as arbitrage funds or hedge funds. These funds manage a large amount of money so even if price changes one or two price tags, the fund can make a profit larger than an individual investor can.

The term bear is used to describe a downward market trend and normally would bring about a recession. The etymology has different sources. Some say that the eyes of a bear are always looking down when it attacks. The widely used definition is used to describe a drop of 20% from the highest point; thus entering a bear market. Meanwhile, some would use the drop below the 200 or 250 average lines, sometimes simple mean average and sometimes weighted average line, but not as popular as the 20% definition. However, the period should be of two months or longer, or else it will be treated as a Mirage, such as the Circuit Breaker of March 2020 of Dow Jones when it had a sharp V-shape rebound in April. It is also called a Fake Bear Market or a Mirage of Bear Market. Basically, a bear market is divided into three stages.

(Stage I) Denial

When the market drops, people may not believe that the bear market has arrived, often they may treat it as the correction of a bull market. Often, the market sentiment is still strong and of an upward trajectory, investors still want to buy at a lower level to prepare well for another soaring. Some experienced investors are aware of this but not sure and always being criticized. They will still wait for confirmation.

(Stage II) Collapse

The end of Stage I normally is in narrow range and when sudden news hits, no matter if it’s from the North, East, West or South, it can lead to a great drop or even panic selling. Hence why no matter whether it’s good news or bad news, the only reaction one would expect is a fall – this is typical Bear Market Stage II. Market sentiment is pessimistic and weak. People often sell regardless of the price as they’re afraid of further drops. A lot of people prefer to hold cash instead of securities or change to another market. Normally, this signifies a recession.

(Stage III) Recovery

After a series of overselling the market will drop to the bottom at last, which is difficult for people to believe and therefore they will wait for confirmation. This reaction is always mixed. Investors find it hard to judge whether a small upward wave is just a rebound of the downward trend or the end of the fall. The low can continue to drive further down, but the span is narrower. Therefore, it continues to drop but every wave is smaller than the previous and thus gives hope that the end is not far.

However, a Bear Market cannot stand alone and must cope with the market cycle and wave theory. The difficulty of a Bear Market in stocks is that most people can get loss, even if they do make profit this may be quite small and short period. It is different from the gold market and forex markets where both directions can be the same. Small investors are unable to change this situation and only can leave the market or turn to other markets if the bearish trend continues. Refer to Bull Market please.

This is a two-way quoting system in the financial market regardless of whether it’s in stocks, currencies, gold, bonds or any other products. Sometimes is also known as Bid & Offer. It indicates the best potential price at which a product can be sold and bought at a given point in time. The Bid represents the maximum price that a buyer is willing to pay for that product at that time, whilst the Ask indicates the minimum price that a seller is willing to take for that same product. They are shown at the same time. A transaction occurs after the buyer and seller agree on a price for the security which is no higher than the Bid and no lower than the Ask. Let’s use the example of TESLA on 10th Dec, 2020.

| BID 604.07 | ASK 604.13 |

There is a buyer in the market that wants to buy in at the price of 604.07 and if investors want to sell it immediately they can sell at 604.07, leading to a transaction price of 604.07. Meanwhile, there is another seller in the market wishing to sell at 604.13 and the seller and the potential buyer cannot come to a compromise. If the investor wants to buy they have to meet the seller price which is 604.13, meaning the transaction price is now 604.13. Therefore, each transaction is made up of three prices, the bid, offer, and transaction price. But as for market opening and market closing price, there is only one price. That is just the transaction agreed and is more about doing a deal and seeing who is ready to compromise. Normally the Bid price is on the left hand side and Ask price on the right hand side and the difference between the Bid and Ask prices is known as the spread. For example, 604.13 minus 604.07 would mean that the current spread of Tesla is $0.06. The spread varies from stock to stock because they vary in price. If an investor wants to buy at once they have to use the price on the right, which is higher, however if an investor wants to use the left hand side price, which is lower, they have to wait. These types of deals can sometimes be done quickly or can take forever. If an investor wants to sell at once he has to use a lower price on the left hand side and if an investor wants to buy immediately they’re often forced into using the higher price on the right hand side.

This term has two meanings in the Financial Market besides the traditional definition of Friday 13th which was the Crucifixion Day of Jesus Christ.

It is used to describe the stock crash of up to 20% occurred on 19th October, 1987 (Monday) due to the computerized stop loss orders. Nothing special happened on the market that day, no war, no special policies and no bad news, but just normal adjustment after a great soar hit the computer stop loss. It was the first time that a large amount of computerized stop loss worked together and generated a domino effect, leading to an avalanche in the stock market. Later on the Security and Exchange Commission (SEC) built a number of protective mechanisms, such circuit breakers to prevent such panic-selling. On 13th October 1997 (Monday) and 27th October, 1997 (Monday) there were small crashes thus making people fear Monday for quite a long time. Luckily, this hasn’t continued. Equally, the stock crash of 28th October 1929 (Monday) of 12.82% also made people fear October for quite a long time.

It is used to describe the first day of stock crash on 24th October 1929 (Thursday), which resulted in an 11% loss.

This represents the stock crash on the fourth and the last day of the stock crash which happened on 29th October, 1929 and resulted in a drop of 11.73%, kicking off the Great Depression of the 1930s.

It is used to describe the short selling of the Great British Pound (GBP) on Wednesday 16th September1992 where The Bank of England (BoE) supported by G7 central banks managed to maintain the lowest exchange rate and had to withdraw from the European Exchange Rate Mechanism, ultimately leading to the birth of Euro. George Soros made a profit of US$1 billion on that day and The BoE suffered a loss of £3.3bn. It is also a day to mark down in the financial market calendar, as it shows that central banks are not all in all, they can be defeated in a GBP Bear Market. The G7 banks are known as invincible, it is their first and only Waterloo.

This phrase was coined thanks to the casinos in Las Vegas. The largest chip is blue, so nowadays in the stock market they describe the largest companies on the market as blue chips, signaling confidence and stability.

A bonus is an issue of shares to existing shareholders. When a company gets profit they can distribute a dividend in the form of cash, which is a form of interest or additional shares. For example, you may be offered an additional share for every five you own. When distributing dividends in the form of cash, it is a fixed amount, but when in the form of shares, these may rise and fall in the future so you can either make more money or your dividend may even lose value.

The term Bull Market is used to describe an upward market trend and normally brings about a bloom. The etymology has different sources. Some say that the eyes of a bull are looking up always and when it attacks, it is striking from the ground upward. The widely used definition signifies a rise of 20% from the lowest point and is known as entering into a Bull Market. Meanwhile, some would use the rise above the 200 or 250 average lines, sometimes simple mean average and sometimes weighted average line, but these are not as popular as the 20% definition. However, the upward period should be of two months or longer, or it could be treated as a Mirage. Basically, a Bull Market is divided into three stages.

(Stage I) Worrying

When the market stops falling people may still be skeptical that the Bear Market hasn’t ended and just see it as a rebound of the Bear Market. Market sentiment is often shifting – sometimes positive and sometimes negative. When the top of a small wave is higher than previously, it can change the sentiment, however if it’s still in the bottom of the medium wave and lower than previously, there will still be fear. Every purchase will be meticulously short in anticipation of fear of another drop. This is where investors can really benefit from buying small amounts and exiting the market soon just after making a small profit to avoid another great fall. Sellers will want to sell at a higher level to make profit but always fail. Experienced investors will be aware of this. They will still wait for confirmation. A lot of people tend to hold a long position but anticipate a drop.

(Stage II) Building

The end of Stage I normally is in narrow range and when sudden news comes, whether it be from the North, East, West or South, it leads to a soar. Hence no matter if it’s good news or bad news, there is only one reaction and that is a rise and this is typical of a Bull Market Stage II. Market sentiment is optimistic and strong. People will buy no matter at whatsoever price in fear of further increase and understand that they can no longer buy at such a cheap price. A lot of people want to gather money to buy the product or change the investment from other markets to this market. Normally, the society is also in bloom.

(Stage III) Euphoria

After a series of buying, the market will reach the top at last, yet few people believe that this is truly the top, or maybe they do believe but they still have to wait for confirmation. It is always a mixture. Investors find it difficult to judge whether a small downward wave is just a correction of the uptrend or if it’s the market falling. Only a small drop will attract a lot of buyers who enter the market in anticipation of further rising.

However, no matter what a Bull or Bear Market cannot stand alone and must cope with a market cycle and wave theory. Normally, in a Bull Market of stocks everyone can make profit no matter which stock they choose. Often, an investor may feel they are being clever, but actually everyone is smart in a Bull Market. This is possibly the largest attraction of the stock market in such a situation, for investors can choose their product and every time they are choosing the right product. However, investors should be aware of such a situation and know it is different from the forex and gold market. Refer to Bear Market please.

Basically, there are two ways of making profit in the stock market. After investing money in shares, when the price rises, the money made minus the commission, handling charge or storage charge, is known as capital gains. The dividend (interest) is another portion so that people can calculate both rates individually or simultaneously and compare shares to evaluate which shares are worth investing in.

This is a Trade War that has always caused misunderstanding and is sometimes known as the Sino-US Trade War. The official reason is actually nothing to do with trade deficit. On 22nd March 2018, former US president Donald Trump solved the North Korea nuclear crisis and turned to issue a Memo against China claiming that China has stolen US intellectual property, thus leading to loss of several ten thousand jobs and to a great trade deficit. The problem of solving is on tariff, it is just a means of solving the problem and not the reason. That Memo is said to be a Declaration of Trade War colloquially. The US intended to apply US$50-560bn on China in July. The Trade War on deficit already started in January when the US levied a solar panel tariff on China. After a series of Trade Talks, the agreement was signed on 15th January 2020 as Phase I, mainly concerning purchasing of agricultural products, and Phase II is scheduled to be discussed after the Presidential Election 2020, for it’s extensive. The Phase I agreement is considered a grand victory of Trump, for China has to do much whilst the US can sit back. Chinese citizens considered it as a great insult, for they established a squadron in China made up of US and Chinese policemen. That means US police have the right to order Chinese police to correct the illegal action of disc copyrights in the market which has been a problem since the Dot Com Bubble of 1990s and China has promised to improve but has not made much progress in several decades. However, it is yet to come into action because just one week after it was signed we saw the beginning of Coronavirus and the whole world went into shut down. Actually it is just a starter but hard to make people in mainland China accept it. Phase II will be concerning the high technology of national defense and shift of intellectual property for companies in Silicon Valley etc, which will be even more complex to discuss.

The normal and standard stocks that investors buy in the market, please refer to Preference Shares in contradiction to this.

Same as Adjustment.

A kind of Limit Order valid for one day only, please refer to Limit Order.

This is a kind of trading method specially designed for gold, currency and indexes with a fixed profit taking and cut loss level by stop orders. It is suitable for those investors who want to trade every day but not sure of which direction the market is going. It can minimize the loss and avoid great loss even if the market drops off a cliff edge, however, this does mean that the profit is also confined. It is useful for small investors, beginners and those afraid of great loss. However, it is not suitable for individual stocks but still applicable to indexes. It has been ongoing in the Bullion Express of Hong Kong broker in the trading of gold since 2005 together with the arbitrage.

This is a term that always arouses some misunderstanding. It has nothing to do with precious gemstones but is in fact the nickname for the SPDR Dow Jones Industrial Average ETF, managed by State Street Global Advisors. It’s the transaction of index and not diamond, refer to ETF please.

A dividend is the distribution of a company’s earnings to its shareholders as determined by the company’s board of directors. Normally it is distributed twice a year. For example, if a company gets nine dollars profit per year, there’s no requirement for it to disperse completely, they have to reserve some for future development, or give our five dollars in two transactions, such as three dollars in mid-year and two dollars by year end. Equally, they can just send it all out mid-year and nothing at year end. It is sometimes known as “interest”. For long-term investors such as pensioners, this matters to them as they like to choose stocks that carry a higher interest than the banks. For short-term investors, this isn’t as important as they’re more concerned about the price because by the time dividend day comes, they have already sold the stocks. Finally, medium-term buyers care about both, because if the price falls or the increase isn’t as much as expected, they can still get interest as a consolation prize.

It is an estimate of the return of a stock investment by dividend only. Assuming the dividend is not raised or lowered, the yield will rise when the price of the stock falls. And conversely, it will fall when the price of the stock rises. Because dividend yields change relative to the stock price, they can often look unusually high for stocks that are falling in value quickly. This is useful for long-term investors such as pensioners.

ETF stands for Exchange-Traded Fund and it involves a collection of stocks which are traded together as opposed to as a single stock. However, they appear to be a single stock and they typically trade the index, but with less risk than trading the commodity exchange index which can suffer margin trading. Nonetheless when trading as a stock, it’s customary that the full payment is needed. ETFs can be based on Indices, Gold, Currency and Commodity, and Bonds and can be issued by different Groups. The most famous ETFs are:

(or Ex Bonus Date). Please refer to Ex Dividend. It is the date where investors can get profit from the company but in the form of shares and not cash, the date where the price will be cut lower according to the value of bonus issued.

(Or Ex Dividend Date) This is the key date when stocks disperses the dividend (interest) to shareholders, and can take several steps. First it’s declaration day – when they announce how much dividend they plan to distribute, giving investors time to buy in if they’d like to benefit from this interest. Then they have a Record Date, if investors buy the share on or before that day and are on the list, they are entitled to get the dividend, but if they’ve already sold out and not on the list on that day, there will be no interest. Finally, the Payment date comes later, that is even if you are on the list on the Record Date and sold out on the following Date, you still can receive the dividend on payment Date. Ex-Dividend Date is the date that interest is deducted from the price. For example, if the dividend is 2 dollars, the closing price of the previous date is 100, then on the Ex-dividend Date the opening price will be 100-2=98. However, if you have a savings account and can get a 2% annual rate you can get back 102 dollars on the whole. Ex-Dividend is a concept carried out worldwide and no one can complain, but should familiarise themselves with it. Take the example of APPLE, the cash amount of the last dividend in 2020 was $0.205, the Declaration Day was on 29th Oct (Thu), the Ex-Dividend Date was 6th Nov (Fri), Record Date was 9th Nov (Mon), and Payment Date was 12th Nov (Thu), but the US government collected 30% dividend tax. So, if you had 30 shares of APPLE in hand you could get $0.205 x 30 = $6.15, but still have to deduct 30% tax, meaning you end up with $6.15 – $1.85 = $4.3

An extra dividend, sometimes called a special or irregular dividend, is a one-time dividend paid to a company’s shareholders outside of the normal yearly or half-yearly schedule.

The crisis triggered by the bankruptcy of Lehman Brothers in 2008 and very often known as the Great Recession. Refer to it please.

Refer to Market Analysis please.

It occurred in the stock crash of 1929 which brought about world recession by the US and generated the terms Black Monday, Black Tuesday, Black Thursday and Black Friday. It’s the greatest recession in the 20th Century and has yet to be surpassed. It is also used as a symptom of globalisation. That means the rise and fall of the US economy affects the whole world. The US unemployment rate was up to 25% and some countries even higher. Later on, historians proved this is one of the far factors of World War II.

It denotes the Financial Crisis of 2007 – 2009, sometimes known as the Financial Tsunami, and is confirmed the greatest crisis since The Great Depression of the1930s. In 2007 the petroleum crisis soared up the price to US$147 and made subprime mortgages more dangerous. The bankruptcy of the Investment Bank Lehman Brothers triggered the Financial Tsunami. America lost 8m jobs and started the QE policy of printing money and unemployment went up to 10%. The G20 Minister Meeting was upgraded to a Summit, since then it goes together with the G7 meetings. That means the first day is G7 and the second day is G20 thereafter. The impact of these unions has continued to grow. It took 6 years to recover and replace the 8 million jobs lost. China and India were unhurt and have grown even stronger since then.

Hedging involves the use of more than one concurrent bet in opposite directions in an attempt to limit the risk of serious investment loss.

Initial Public Offering (IPO) is the first sales of a private company through one or more exchanges. Normally underwritten by an investment bank or brokerage house to sell to the public including individual investors and institutional investors. It is also treated as a means to raise funds for future development. After this process, the shares of that company are said to have free float on the market. When a large firm establishes a subsidiary and decides to IPO, it is usually welcomed because investors trust the company because of the reputation that it has built.

It’s one of the 3 trading orders on the market, namely (1) Market Order, (2) Limit Order (3) Stop Order. Investors can refer to the other two for a comprehensive understanding.

| BID 604.07 | ASK 604.13 |

When an investor wants to buy a stock but finds the current level is too high regardless of Bid & Ask Price, they can place a limit order to buy at a lower ideal price and therefore don’t have to watch the market continuously, allowing him to get on with other activities whilst not missing their chance. Take the former example of Bid & Ask.

If an investor thinks that their ideal price for purchasing is 600.00, they can place a limit order at 600.00 so when the price drops to that level, the computer will automatically buy in. However, this is not guaranteed to happen, so they may miss out forever, or it may happen immediately. Therefore if an investor wishes to sell at a higher price of 607.00, they can also place a limit order. In most cases, the limit order is workable for that trading day only, but some companies can choose a one day or one week limit order. It depends on individual companies. The one week order will become invalid on a Friday no matter which day of the week the investor placed their limit order. However, when a limit order is placed, the required amount of transaction money is frozen and cannot be used even if the transaction has not happened yet. A Limit Order can be placed before the opening of the market and can use the first price no matter how high or how low it is. Thus it is called MOO (Market On Opening), and can also be placed on the last price which is MOC (Market On Closing). So Limit Orders can be classified in the following:

Long is used to describe the position or the “bet” an investor may have taken and denotes the investor buying the product and holding it. It can be used for stocks, currencies, bonds or indices etc. It is not just a market sentiment, but a market action which takes a long-term view. Refer to the short position please.

Quantitative Easing (QE) Policy is monetary policy used to save the economy through the buying of securities or bonds by the central banks so as to inject more cash into the society. Normally, the central banks need to print more money to handle this, thus it depreciates the currency. Later on, if the economic cycle blooms because of the injection of capital, the currency rate becomes stronger and is said to be successful in saving the economy. In the Great Recession of 2008, the Federal Reserve did 3 and a half rounds of QE.

The additional deposit needed to fill in before total loss. Please refer to Margin Trading. The time of calling and amount needed varies for each single brokerage firm.

This is when the brokerage firm only asks the client to pay part of the buying or selling fee for trading. Typically, in the stock market this margin is higher and could be between 20% to 80%, however in the commodity markets such as currency and precious metal, the margin is lower and could be as low as 5% to 10%. When the margin is higher, it is of lower risk however therefore not attractive enough to investors. When the margin is lower, it is quite attractive but the risk is higher. For example if the margin is 80%, that means on purchasing a product for every $1,000 investor only need to pay $800. This means that an investor can save $200 dollars each time and therefore afford to purchase 6 products for the price of 5. It is quite flexible, however not so attractive. But if the margin is at 5%, an investor only needs to pay $50 to purchase $1,000 of that product, so it’s quite attractive, but the risk is higher. For if the product drops 1% for 5 days, then all of the investment will drop to zero. Therefore, before it goes to zero, the brokerage firm will ask the investor to deposit more money to prevent zero point comes, it is known as Margin Call.

This can be divided into two sectors:

A kind of Limit Order known as Market on Closing, please refer to Limit Order.

A kind of Limit Order known as Market on Opening, please refer to Limit Order.

In advanced financial centres of the world like Hong Kong, it is used to lessen the pressure on investors, general office workers and patients so as to re-create more energy to face the unknown future. The author is also an amateur Music Therapist and plays the piano in Queen Mary Hospital on Saturdays for patients, medical staff and family visitors. On weekdays there’s often a lunch hour concert in the Art Corner of The Centre for office workers and the general public, and sometimes there is a concert with students playing other instruments. The author has also released a CD with five arrangements of ancient China to soothe and bring peace and calm to everyone inside or outside of the financial markets.

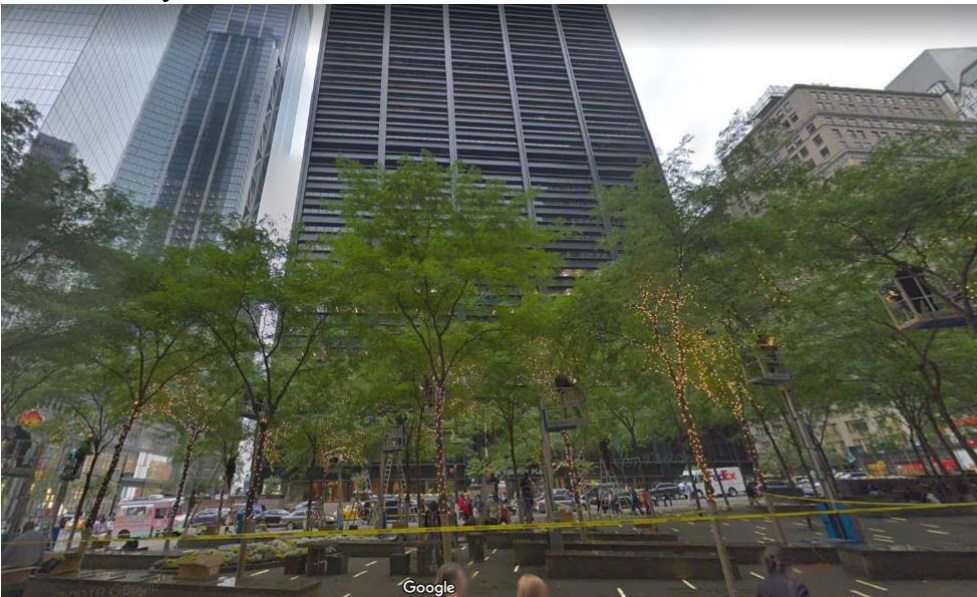

The full name is National Association of Securities Dealers Automated Quotations. Established in 1971, the second largest exchange house in the world just after the NYSE. Listed companies are mainly technology companies. In 1998, it became the first market to trade online. However the location of this exchange always causes misunderstanding. It is situated in One Liberty Plaza of Broadway Avenue, 100 meters away from NYSE, by the side of Zuccotti Park. But they have an observation room in Times Square and a large market electronic board as shown below. This is because the platform for ringing the bell in the NYSE is too small and can only accommodate 7 or 8 people. For the NASDAQ when there is an IPO, the ceremony for newly listed companies is usually attended by hundreds of people, therefore a larger space is needed – hence why they have established a larger place for market watching and ceremonies. After the ceremony, go downstairs to Times Square and take a group photo with the large market board in the background, therefore people always assume that the NASDAQ is situated in Times Squares. Actually, the site in Times Square is a market watching room and ceremony hall, not an exchange house. Investors cannot do any trading in Times Square NASDAQ.

NASDAQ trading hall in |  NASDAQ market watching room |

In the NASDAQ, the most common used index is NASDAQ 100 or simply NASDAQ. There is also another index known as NASDAQ Composite which covers all stocks in the exchange house but is seldom referred to.

Normally this denotes the latest happenings, or previously unknown stories. However, in the Bullion Express, it firstly and publicly defined it as North, East, West, South is NEWS.

The New York Stock Exchange lies on 11, Wall Street. It came to existence in 1792 when 24 brokers signed the Buttonwood Agreement. It is the largest stock market in the world according to market capitalisation and also the symbol of the financial centre of New York and the world. Sometimes it is also known as the first market or main market when in comparison to the NASDAQ. The building shown is designated as the National Historic Building. At first it used open outcry for trading, later electronic trading and now using hybrid trading where the trader can use electronic or open outcry when they think necessary. It is famous for the opening bell and closing bell where every day they invite celebrities to ring the bell. The Dow Jones and S&P Index are calculated in the exchange however there is still a NYSE Composite covering all common stocks, but seldom referred. Refer to NASDAQ please.

It is a protest movement generated in September 2011 by Canada in a bid for economic inequality – arguing that 99% of the wealth in the world is in the hands of 1% of people and only 1% of the wealth is shared by 99% of people. This is aimed at the Wall Street tycoons which are the concentration of wealth and this movement soon spread all over the world. However, the exact location of the movement did not originate at Wall Street for it is too small and does not have enough room for people to stay. They chose the Zuccotti Park which is facing the NASDAQ of One Liberty Square for camping. Occupying Wall Street really started outside Wall Street.

Zuccotti Park in foreground and One Liberty Square in background

There is a saying that the US stock market will have a crash every October for in the past all major slumps occurred in October, however, in the last 100 years these have only happened three times, meaning that the remaining 97 years have been drama free. Refer to Black Monday, Black Tuesday, Black Thursday and Black Friday please.

It came out not because of shortage of supply but on sanction in 1973. In the Middle East wars, Israel defeated the 12 allied countries of Arabs and Saudi blamed the US for supplying the latest weapons to Israel and thus led to their failure. So they levied sanction on the supply of petroleum to western countries. Actually, the weapons which the Soviet Union supplied to Arabian countries were just slightly weaker and not the main reason for total collapse. The main reasons lie in management, training, maintenance and professionalism. At the same time, the reformation and modernisation of Israel was quite successful. The whole world was in shortage of petroleum and this made the price soared up from US$2 to $12 shortly. The US thus started to sell weapons both to Saudi and Israel so as to solve the problem, which of course made much wealth. At the same time, the North Sea Oil was successfully developed as the second largest oil field and thus lessened the crisis. However, by the end of 1999, the production of North Sea Oil proved reached its peak and began to fall at the rate of 2% each year. At that time, the total reserve of petroleum on earth was just enough for 90 years. The oil price started to soar up in 2000 and in 2001 because of the 9/11 terror attack in New York, both the oil price and gold price rocketed up. Because of fast economic development, the consumption of oil greatly increased and therefore the total reserve on earth is said to now only be able to last 40 years. This made the price of oil go up to as high as $147 in 2007 and is one of the major reasons of the Great Recession of 2007 to 2009. Until the introduction of shale oil in 2015, which ended the petroleum crisis as well as the bear market of gold. Refer to Shale Oil please.

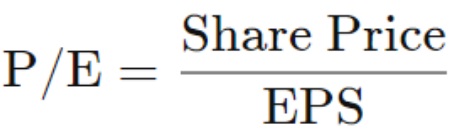

P/E stands for Price-to-Earnings Ratio. It is used to determine the relative value of a company’s shares in comparison to or against its own historical record, or to compare aggregate markets against one another or over time. It varies according to various market situations. The formula is

For example, the last closing price of Amazon on 8th Dec 2020 was $3177 and the annual earnings per share was 12.37. The P/E ratio was 256 – quite high. Normally, for US stocks, when the P/E ratio is between 14 to 24 they are considered as sound and safe and worth investing in. However, P/E ratio should compare with the same category, that is finance to finance, medical to medical or else it cannot be considered accurate. But in December 2020, most of the famous stocks were over 100 or 200 in P/E ratio, therefore the risk was extremely high.

It is the transaction of the NASDAQ Index. Refer to the ETF please.

(or preferred stocks). It is named against common shares. They are shares of a company’s stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy preferred stockholders are entitled to be paid from company assets before common stockholders.

The electronic trading before market opening. Refer to After Trading hours please.

It happens four times a year and lies on the third Fridays of March, June, September and December. It is the date of the expiry of 4 commodities, including (a) stock index futures, (b) stock index options, (c) stock options, and (d) single stock futures. It brings large fluctuations to the market and is known as Quadruple Witching. A witch is a woman with a crooked nose and mounting on a flying broom with a high black hat and cloth, the one who framed Princess Snow White. Her appearance normally denotes bad luck. But is it really so horrible? According to market behavior, when everyone is wrong, it is right. On that day, investors have to make a decision whether they should liquidate or extend the contracts, withdraw or inject capital, cut loss or take profit. They may sell gold or stocks to face the margin call. It is an era of globalisation, so even if one does not usually invest in the commodity, they cannot neglect the Quadruple Witching Day. However, it is not always like this, and often it has to cope with the chart analysis and practical market conditions, meaning sometimes is quite sluggish.

After a period of falling, when the price of a product rises 10% from its low, it is known as a rebound. When the market drops down too far, people often wait for a rebound to come. It usually results from people who have previously shorted the product making profit and thus driving the price up. Normally, it is a nice time for investors to sell if they previously haven’t. A healthy market needs correction and adjustment every now and then. Refer to Adjustment of opposition meaning please.

These came out in the Hong Kong stock market in the 1990s, and are shares owned by the Chinese central government or local government, getting their name from the Chinese flag which is red. It bears no relation to the blue chip (which means large companies), it does not refer to large or small scale, but refers to the Chinese government.

When an investor wrongly enters the market and finds he is at a loss, he looks at how he can save the order and turn the situation around. If the investor buys a product when it goes up he can make a profit of course, but what happens if it goes down. He can wait, but how long may it take? Who knows? The capital frozen will lose a lot of opportunities. This is another way of losing besides the original value diminishing. If he does not want to cut losses and does not want to wait too long, he can use the saving order strategy. For example if an investor buys a product at $50 and it goes down to $40, he can buy another lot at the lower price of $40, so the average cost will be just $45. That means he only needs to wait $5 to break even and not $10, and if it goes to $46 he can make a profit of $1 and don’t need to wait until $51 for the profit of $1. It can shorten the time of waiting and release the capital freely earlier to meet with other opportunities. But he must be sure the drop is deep enough. This should be done by both Fundamental and Technical Analysis.

When a premise is on mortgage to the bank, before the maturity of the loan if the owner needs money he can borrow money again from the capital that he had already paid to the bank, this is known as a second mortgage. At that time the bank will re-evaluate the building according to market price and not according to the capital that’s already been paid, so it may be worth more or it may be worth less. This must be done with the same bank so the bank can get hold of the deed. However, nowadays other banks may offer the property owner a second mortgage, however, before full payment the original bank may not release the deed. So it becomes almost a personal loan. Second Mortgage should not be mixed up with Subprime Mortgage.

Shale Oil is an unconventional oil deep down under the rocks. It cannot be excavated vertically and after a certain depth it has to be explored horizontally layer by layer, thus the cost is higher. It had been developed since the petroleum crisis in 1973 but suspended due to the objection of environmental protection. However, in the Great Recession of 2007 – 2009, the Congress decided to explore this oil again in order to save the economy. Basically, it is of a lower quality and cannot be used but they use high technology to transfer it into conventional oil which can be used as normal. In 2012, the US announced the successful development of Shale Oil, but the cost was quite high. The initial cost was $120, at that time the market price of petroleum was $110. Anyway it is a means of keeping the price down so it does not reach a record high again, but does not do anything to lower the price. As mass production carried on, the US overtook Saudi as the largest producer in the world in 2014. Therefore they no longer need to depend on the Middle East again. In 2015, the US even had an oil surplus and was able to export to other countries. Once the US had the largest consumption and was the largest importer of oil and now it has become an exporter. Technicians have continued to develop new methods to lower the cost. Oil prices fell greatly from $120 to $20. In early 2016, it ended the petroleum crisis that lasted from nearly half a century and gold also ended the bear market and started another bull market.

Short is used to describe the position or the “bet” an investor makes, and denotes the investor is selling the product and does not want to hold it, regardless of whether it’s a stock, currency, bond or index. It is not just a market sentiment, but a market action which denotes negative future outlook. Please refer to the long position.

Refer to China-US Trade War please.

One of the largest trading of ETF in the world of the S&P family, the name SPDR is pronounced as “Spider”. Please refer to the ETF.

The difference between buying and selling price. Please refer to Bid & Ask.

It is the money borrowed by lower class clients on the Property Mortgage. Normally banks prefer upper class clients, that is those working in large enterprises for 10 years or more with a high management level. That means their job is stable and repayment power is strong. Their company should not vanish in a single day. But banks also have to face keen competition that these clients may have already been seized away by other banks. Thus they have to aim at lower class clients, maybe those who have just graduated from school or taken career breaks. For money lent to lower class clients is often at a higher risk thus banks often charge higher interest rates to cover this risk. A lot of major banks may even establish a subsidiary institution for such money lending. Major banks have a location in downtown and in major finance centres or ground floor and main street branches, however, subsidiaries tend to be small with offices upstairs where the rent is lower. When chasing late repayments, large banks must do it politely and everything must be done according to rules and regulations, thus it is a long task. However, small firms can be more direct. If a situation arises where money is lent to a lower class client at a higher interest rate, their lower office costs and lesser known name means they can often chase back the bad debt. However, large banks who have high office costs and lend money to first clients at a lower interest rate, often end up losing money when a client defaults on their loan as they often do not have the means to chase it. Therefore even large banks aim to acquire lower class clients. But their income is not so stable, in an economic bloom of course they can pay back easily, but in recession such as the crisis brought by the high petroleum price they are unable to pay back their debt and even unable to borrow money to fill the gap. They collapsed and led to the financial institution facing a great crisis for many of them are over-lending to lower class clients and hard to chase back the money. This is one of the major reasons that led to the Great Recession of 2008.

Please refer to Market Analysis.

The price agreed on between buyer and seller to make a deal, please refer to Bid & Ask.

It has two meanings. The narrow meaning denotes the 700m street. The broader meaning is a symbol of the financial industries of New York. At first it was both the political centre and financial centre of the US. The Federal Hall is located at 26, Wall Street where George Washington sworn into office and became the first US president. It is also the first Congress Building. After the District of Columbia was built, the political centre moved to Washington and this street was known as the financial centre only. The attached photo is a shot from Federal Hall with the statue of Washington in the foreground overlooking the New York Stock Exchange. It is a pedestrian zone now and only emergency vehicles can enter.

| Overlooking NYSE from Federal Hall with statue of George Washington as foreground |

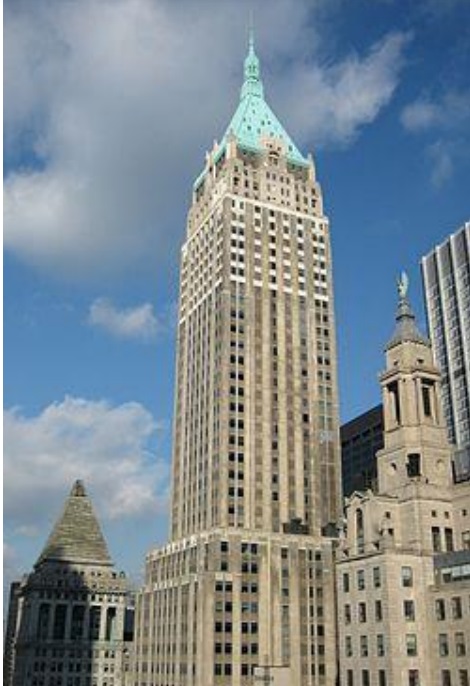

| Trump Building in Wall Street |

| Federal Hall Memorial Building and statue of George Washington in centre |

It’s important to note that the NYSE is in Wall Street, while the New York Mercantile Exchange is in North End Avenue, the American Stock Exchange (NYSE American) is in Trinity Pl and NASDAQ is in Broadway. Most of the financial institutions have moved away to midtown since the space here is quite limited. However, the Trump Building (not to be confused with the Trump Tower which is on Fifth Avenue) is at 40 Wall Street.

A kind of Limit Order valid for only the week.