Key summary:

Market analysis and forecast need deep understanding, both on basic theory and international happening. Forecast come from analysis, without analysis there would not be any suitable forecast. But what is a comprehensive analysis? It must have abundant data in order to have anatomical understanding. Therefore both knowledge and experience are needed.

In studying basic theories like Elliot Wave or Fibonacci series, some said very accurate some said not as expected. It actually depends on experience besides basic knowledge. All theories are the same but just see how to apply. For technical indicators there are nearly 100 hot indicators in the market and when including non-popular indicators there will be over 200. Beginners normally would ask which indicator is most accurate, if there is such an answer, the rest 99 or 199 indicators will be eliminated and no more can exist on earth. A smart investor would ask, which indicator should I use during the current condition, for next week or next month may be completely different.

Such as people may ask how to play the chess, no matter international chess, Chinese chess or GO (black & white stone chess). The scope is too large to answer. I only can give an answer at a definite stage to take a better action. The live example of this allocution is aiming at combing the theory and experience together, but each example has different applicable conditions so investor have to understand more and experience more so that they can apply their theory to the most suitable market condition. Such as under what condition they should use standard trading and under what condition they should use reverse trading.

Chart analysis is not being taught in university, for it needs experience more than theory. That is after you learn the Elliot Wave, Dow’s Wave, Gann Wave, Wolfe Wave or Neo Wave, they may not come true and let you lose money. The problem does not lie in the theory, its lies on experience, at which time you should apply Elliot Wave, at which time you should apply Dow’s, Gann, Wolfe or Neo Wave. Even a super professor cannot give you an all-in-one definition and application guideline. It’s an ever changing world; the market is an ever changing trading house. What we need to do is not just guessing the price will go up or down, not as simple as placing the black and white stones of the GO, that the buyer takes one step and the seller would follow to take another step.

So let’s GO ! GO ! GO !

A lot of investors like to follow those famous people to buy for they are confirmed as successful investors and should be smarter than individual investors. So the writer picked up some live examples to discuss.

(a) Elon Musk & Warren Buffet

According to the ranking of Apr 2022, Elon Musk is on the first ranking of wealthiest person in the world, and Warren Buffet only on the sixth rank, but when both cases are put in front of us concerning their purchasing choices, we should have a careful evaluation one by one. Basically, in such a case, there are four choices (i) follow both, (ii) only follow Elon Musk, (iii) only follow Warren Buffet (iv) quit both.

(a1) In April 2022 there are two famous purchases in the market, it is a hot topic of buying, that is TWTR and ATVI. Which one should investor buy? Or both? Or not buy completely?

When TWTR release the news of purchasing, the market price is $47, and the level of buying announced is $54.20. That means if investor buy at once he can have a profit of nearly $7. But the market price is going up and down every day, people who buys it simply believes in the attraction of Elon Musk, such as he would announce more new projects before the deadline which can make the price go up to $60 or $70. What they believe is in the future charm of Elon Musk and not the official price of $54.20.

Figure (i) TWTR

When referring to chart analysis, the most prominent pattern can be seen is a jumping gap. In most cases of US stock market, the jumping gaps will be re-filled with exception to purchasing announcement for the gap is too large and enormous buying is on the way.

Therefore the pattern seen is just only a symmetric triangle, which means the chance of going up and down are just half and half. Why there is a chance of falling? Because Elon Musk has made a silly mistake. According to the rules of the Security Exchange Commission (SEC), any purchase up to 5% should report to them within 10 days but he failed to do so and may need to face a court case by shareholders that liquidated so early because of not knowing his purchase and thus lost a gap of making profit. The board of directors is also in objection of the purchase and may launch out a project of Poison Plan to issue more shares so hard for him to purchase in short time and the price will go down because of large quantity issued. Meanwhile, the purchase had a deadline and the stock will go private that means cannot hold it for long when the price goes down. Even later say may be re-listed two years later.

For details please refer to The US Stock Express (hereafter called The Express) of Apr 5, 18, 19, 20, of the year 2022. Investors can also learn from the character of Elon Musk, the writer shared 3 major points in The Express of May 17, 2022.

(a2) While Warren Buffet also disclosed he would increasing the holding of ATVI through the BRK.B, and MSFT would buy it back at the level of $95. At the time of disclosure, the price is $78.6, it is not a purchase of the whole stock, they are just holding more in their ETF. Of course in the future they can sell out. But the current price is just only increase the hold of stocks and no deadline of going private and any court case or poison plan ahead. Everything depends on major condition of the market. According to chart analysis, the price is going in a horizontal platform, but weakening at last because of the fighting between Russia and Ukraine. The spread of Omicron in China led to wide scale of lock down in major Chinese cities in form of relay. These two factors also deepen the worry of Stagflation. This denotes the worry is of the whole market and not just that stock. For details of comparison between these two stocks, please refer to The Express of May 3 of the year 2022.

Figure (ii) ATVI

Thus investors can make their own decision which stock should buy, or both do not buy, or just buy either of these two.

(b) Donald Trump, Mark Zuckerberg & Elon Musk

These are Three Musketeers of the market which are Truth Social, Metaverse and Twitter respectively as shown in the The Express of Apr 27, 2022, they group together to bring a new scene in social media which is on the way. We can expect a splendid scene of competition is coming. Under free market theory, end users will be most benefited, but competitor may win or lose, may success or fail. Investors should evaluate carefully so as to bet the right horse.

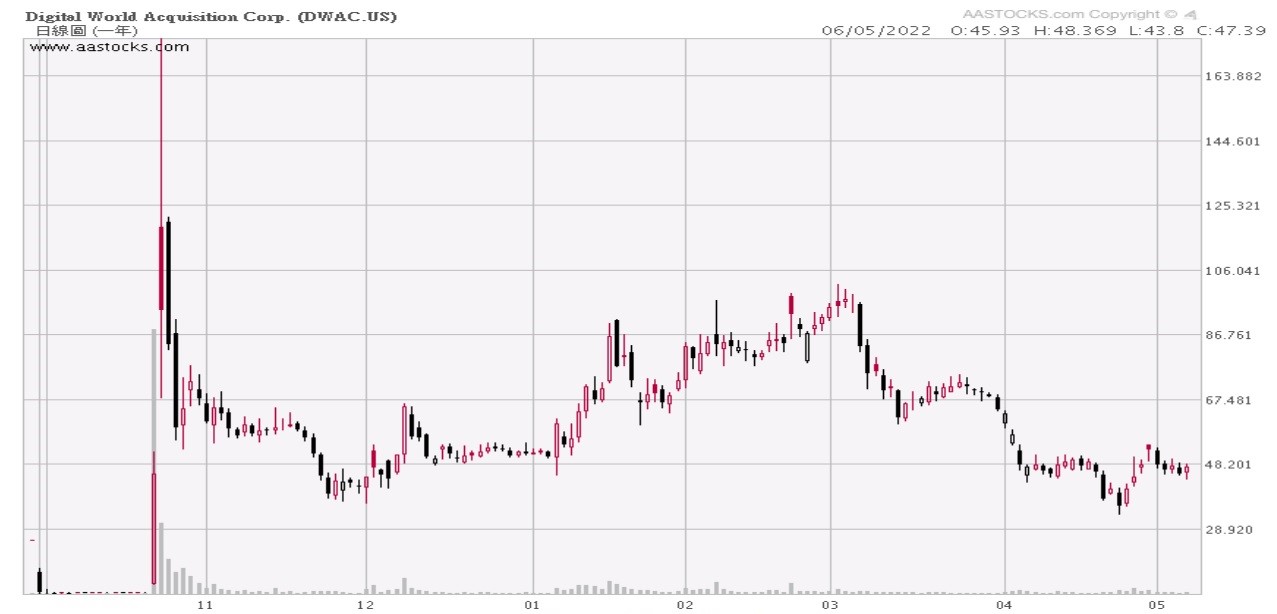

(a1) Donald Trump is using the method of Reverse Takeover or sometimes known as Backdoor Takeover to vitalize his “Truth Social”. Make it simple, he uses the Special Purpose Acquisition Company (SPAC), to purchase a shell company or a company that is poorly run so as to adopt his new company “Truth Social”, where some people think that the process can be faster. The DWAC went up for 400%, but we have to neglect it unless Donald Trump personally noticed you of the purchase only and would not tell any other people. After the great fluctuation, the writer told investor to buy on Nov 15 where the previous closing was $69.86. Henceforward, the writer re-iterated several times the target is at $100 and investors can take profit either at 97/98 or 102/103. From Feb 7 to Mar 4, it has 4 times to go up beyond $105. Investors should have enough time to take profit no matter they cling to the earlier target of 97/98 or later target of 102/103. Later as NASDAQ turned down, it fell back to $38 on Apr 25. So the purchase of a stock must have a target both in time and price or else you will turn the profit to loss. When the target is reached, do not linger any more or else every profit will go back to ground zero. Please refer to The Express of Nov 15, 2021, Jan 19 and Feb 8, 2022 for further details.

Figure (iii) DWAC

(a2) Mark Zuckerberg, on Oct 29, Zuckerberg announced to rename Facebook with effective on Dec 1, 2021; but the code remains unchanged as FB. Facebook is the first generation of social media in US and every country develops their social media in their own language base upon Facebook and did made a lot of improvements and in some cases even surpassed the function of Facebook. Now it is entering into the second generation which changes from 2D to 3D which means the dimension will be out of a piece of paper and seemed to exist vividly in front of the viewer, and then develop into 4D which includes the effect of windy, rainy, smelly, tasty effects. That means when you are watching the typhoons of Hong Kong, you can really feel wind blowing from the window of your living room. When you are watching the Niagara Waterfall, you can feel water droplets on your face. When you are watching the news of fighting in Ukraine, you can feel the heat of explosion and dust on your face and hand. Your living room at once turned to a battlefield in Ukraine. When you are watching the cooking of Chinese food, you can feel the smell so real. Furthermore, 5D is that when watching a jeep going over a mountain, your seat will bounce you up and down according to the running of the jeep over the ramp. Of course you have to upgrade your software and hardware completely to meet with the requirements.

When applying to financial market, you can attend an online training course with me. In order to make the atmosphere closer and lessen the pressure. You need not to travel to the conference room to attend my lessons. You can see me sitting in the sofa of your living room and talk with you. When you open a chart, you can see me walk across and point out the breaking through level in your chart, but actually I am still in Hong Kong but doing the same action in Hong Kong and you can feel me doing in your living room. Students in 5 continents can also see me walking in their living room and talk with them on the charts for those that they wish to have a deeper understanding according to their wish. Of course, it won’t come out tomorrow, but anyway they are aiming at such a level or even higher. It is hard to say whether this world is real or virtual. They are working hard and prototype is on testing now.

Figure (iv) FB

So why the price of FB fell greatly? When the announcement was made in late October, the price did went up and then goes horizontally, NASDAQ reached the peak in mid Nov and FB went down with the index a little. But during the result announcement of Feb, it found the business was gloomy. Because strong competitors like MSFT, AAPL, GOOG, AMZN, they are working day and night on such targets and the progress in FB was relatively slower. The price dropped greatly on Feb 3 and the writer said not yet the time to buy on Feb 4, and repeated not to buy on Feb 18, but said can buy on Feb 25 and Mar 1 which means no need to wait for re-filling of jumping gap and can buy first. In early April, TWTR joined the competition and made it fall further until TWTR confirmed would go private and no Poison Plan, thus FB rebounded. Anyway, when the price falls, do not hurry to buy, after buying, must prepare it will still go down for a while less you will be disappointed.

(a3) So no matter for FB, DWAC and TWTR, the prices of Three Musketeers are inter-related, but does not mean when one goes up the other will run on the same direction, they can run in opposite directions. And not only this, must also refer to AAPL, MSFT, AMZN, GOOG for they are also developing the Metaverse, and running in different pace, one after each, neither of them can be neglected. However, it must be referred to NASDAQ first and then Dow Jones and S&P. But must also refer to other direct or indirect competitors also. Such as DWAC is formed not just for social media, but also wish to replace CNN, where in the last election, a lot of news concerning Trump was banned by CNN, Facebook and Twitter. So when around the midterm election of 2022, there should be a high in DWAC. When DWAC is confirmed to launch out for individual clients to download on Feb 21 (President’s Day), DWAC started to rise from early Feb, FB and TWTR started to drop. And when the Fox news announced they might put some of its content for the application of Truth Social and Trump silently encouraged Musk to buy the TWTR, it is believed there are safe haven for Trump’s free speech not only in DWAC, but also in TWTR, they rebounded together with FB. Later, Elon Musk said he would release of Trump’s the frozen account in TWTR, but actually he does not need it for he already has his own company.

The former president’s answer to TWTR is trying to merge the best of FB, Instagram and TikTok on Truth Social. Also with the function of Whatsapp, and the news of CNN. These will be supported by Fox news and a keen competition of Three Musketeers of the market are on the way that they must upgrade themselves not only for their domestic market, but also have to face the keen competition from the Chinese market of TikTok. Thus lead to a new scene in free competition. They are providing different services in similar field and we have to evaluate who can run out. Therefore we need to study the projects of these three companies completely no matter you have bought them or not. The Express of course will provide relevant information time by time, but one more thing which is more important than that. Studying chart analysis and company plan is not the most important thing, to experience the world of Metaverse or Omnivores is above all. Metaverse is a new world, what we need is not to discuss the armchair strategy but to experience on your own.

(iii) George Soros

George Soros is the only person on earth that can defeat the joint action of G7 central banks. When the most powerful seven central banks of the world united together they should be invincible, but they only loss one battle, that is on the Black Wednesday of 1992 during the British Pound crisis in the UK. Henceforward a lot of people wished to follow his trading, for following him is better than following the 7 most powerful central banks of the world.

In trading of US stock market, a lot of people forget there is still an index which is of great importance that is the US Dollar Index. Especially when recently the rate increasing cycle started and USD Index is on the high of 20 years which affects stagflation very much. There are two things investor can learn from George Soros.

Firstly, do not just follow the buy or sell of each trading but must learn from the essence and understand all background reasons. When Soros wished to develop his market in China due to the enormous population, his head office is set up in Hong Kong in 2010 and not in mainland China. The writer re-iterated many times, when trading China concept stocks, should also mind the policy of Chinese government besides the company policies, but for other stocks, main emphasize is on company policies. George Soros is a smart investor, he shown this 12 years earlier than the suggestions of the writer. From the experience of the Ant Group, the largest IPO of the world and the incident of BABA, it shows that he is correct. The writer said several times these years avoid investing in China concept stocks because of the hard rules of the Chinese government is always changing. But George Soros already realized this long ago. He had said nothing but just established his Asian Head office in Hong Kong and that in Shanghai is just a branch or working zone.

Figure (v) USD Index

Secondly, during his inauguration of head office in HK, he held a series of seminars in the Hong Kong University, to train the future stars and to find more capable assistants for his office.

During his seminar period, he disclosed he held a lot of short positions of USD, but when some investors followed him the market turned up and suffered loss. Investors should not follow just by a single speech superficially, and must understand the whole process. Also no need to worry the positions he said is really true or not. The point is that the currency market is so enormous that even 7 central banks combine together cannot control it. Even he said so, investors may not follow him completely.

He said that he held a lot of short positions of USD, is it true? He is true, but not so simple. The financial market is not like casino in Macao, where you place your bet in the roulette and just buy red or black and the chance is 50 to 50. Even if he said so, the chance is not just going up and down, not half to half as the bet in casino. He did sell the USD, but he had not told you when did he sold it, may be 3 days earlier, may be 3 week, months or years. And how about his volume? May be 3 lots or 30 or 300 or….at different levels, have different lots. He is a great investors and surely would not place just one lot, for even individual investor may divide into several times for trading, just to trade one lot this week and another next week. Above all, his background is different from us, a cut loss of 10 lots or 100 points to him is nothing at all, but to some investors will be a tremendous loss. So when following the celebrities, must mind such backgrounds.

Above all, you don’t know when he will buy back. Of course not on the day of seminar, it was sold on the peak of Financial Tsunami long ago. Because of various bailout like TARP of George Bush and ARRA of Barrack Obama, it takes time to come into effect. The rebound time is during the seminar period of late 2009 and early 2010. He sold a lot of USD is true, but when he buys back, it is impossible for him to knock on the door of each individual investor to tell them that he is going to take profit or cut loss. You have to handle on your own. Meanwhile, the short positions were held long ago and have a lot of room to take profit even the market has greater rebound, and his capital is much great than individual investor, and he can even suffer some loss for he has already earned a lot. His capital is much larger, so for the profit margin, that is how long we should wait, to him even 50 point or 100 points are quite enormous while for an individual investor is just enough for dinner and have to wait longer. He does not need to wait for long and can have nice profits. So individual investors must mind when following celebrities to trade, his 100 points is different from yours. You only can know of buy and sell and do not know what time and quantity he held in different stages. That is on breakthrough of 250-SMA and turning point of Ichimoku green cloud to red cloud, he already got a lot of profit, while individual investors though still not enough and still have to wait, and the selling positions will get higher and higher. That is the point should mind.

(iv) Points to learn

What can we learn from the above celebrities? Warren Buffet is known as god of stocks in Asia, in US is known as the greatest investor which means his talent covers every part of investment market and not just stocks. He was born in 1930, this year (2022) is of 92 years of age. He thinks that longevity is important, that is a healthy body can keep you wait until you reach your target in the market, or else if you go to Heaven first and the market rises after that you cannot see it. That’s why the writer keep on speed walking 60 minutes every day after office so as to keep the mind think faster and clearer. George Soros was also born in the same year of 1930, but both of them have no idea to retire and keep on working. Actually investment can be treated as a freelance job even after investment, it is really a life-long career. Few task can be as long as investment and as respected as investment for few industries can help people to make so money directly as that of investment. On the other hand, control of risk is above all. Therefore, to follow or not follow the celebrities is also one of the methods of Risk Control.

Mark Zukerberg even if he is the founder of Facebook, but he would not satisfied, and still keep on upgrading it to Metaverse in right time. He is young and energetic and keeps on a spirit of ever onward and never backward. Elon Musk is a man of all ventures, from electric cars to space travelling, from Starlink to Twitter, down to earth and up to space. Donald Trump wrote a book called “The Art of Deal” and sold 1.1 million which is the best-selling business book of all times, that is beyond his normal job he can still do something special, so Heaven is waiting for you to explore your talent.

Hope investors can have deeper understanding and absorb the advantages and cut off the disadvantages. So one day, wish you can defeat the joint action of G20 central banks. Everything can happen in the financial market. When George Soros learned to trade, it was in underground market of currencies in Nazi’s time, where no chart analysis or computerized calculation, he was just a porter of the British Rail. Who can believe he could defeat the G7 central banks at that time? Such as who can believe you can defeat the G20 central banks in the future?

(v) Sure win Formula of following others

A Hongkongnese movie once disclosed a formula of sure win of following others in betting. That is when you go to the Macao casino, just find one which is of worst luck, that is the people get loss most and buy in his opposite. No matter odd or even, black or red of the roulette. The basic principle is that the casino is winning all the way, so when you find the people of worst luck and buy in his opposite, you can sure win. Actually not just in that movie, some people already had such an idea but had not carry out. The outcome of that movie is that the actor did follow the people of worst luck 100% in reverse, but still get loss. Why? Ultimately, he found that the worst luck people of the casino is not others, but he himself. The story reveals that the problem not lies in others, but yourself.

Therefore, when adapting in financial market, still have to do your analysis no matter following this or that person. For the market is running by buyers and sellers at the same time. When everyone looks good and want to buy, then no one will sell to you and vice versa. So when one celebrity is looking up, must another person looking down and you don’t know him so you could not follow. Anyway, analysis is still important, and that’s why the writer is so keen in holding seminars than just recommending stocks for others to buy or sell.

(i) Entertainment and Recreation

Whether a stock is important or profitable, it depends on the market trend to a certain extend besides the actual power of that stock. Such as the Coca-Cola (KO) is a famous recreation and entertainment stock. The sale is quite stable no matter in which economic cycle, prosperity or recession. Their clients’ coverage is from senior citizens to children. Even the seasonal demand will affect the sales a little, but every year has 4 seasons. That means the sales in Christmas and New Year normally is greater, and the price would not go up every year during Christmas for everyone knows after the festivals, sales will go back to normal. The yearly sale is quite stable.

However, the writer started to ask investor to buy KO and later McDonald (MCD) since later Nov 2021 and had persisted on through Chinese New Year in early Feb of 2022 and then extend to Easter Holidays of Apr 2022.

Basically, this should be considered as a recovery stock. On Nov 24, 2021, The Express first suggested to buy KO with MCD even it has been softened for weeks. On Dec 3, 2021 again suggested to buy KO and AAPL, for that day the bottom confirmed reached on Dec 1. On Dec 7, 2021 suggested to buy KO and AXP. This means even other stocks are considerable, KO is still the best. It is hard to buy at the lowest point, actually the bottom is on Dec 1, but the buying time suggested is from Nov 24, Dec 3 to Dec 7. On Dec 17 reminded to add on trading more. This is market analysts, which is different from a prophet or Indian prodigy. Please accept this practical way than dreaming to buy at lowest point and no more level will be lower than your buying level, and then selling at highest point and no more point will be higher than your selling level. This is the earth and not Eden or Nirvana.

If you can always purchase around the lower level like the above, it is nearly the paradise on earth.

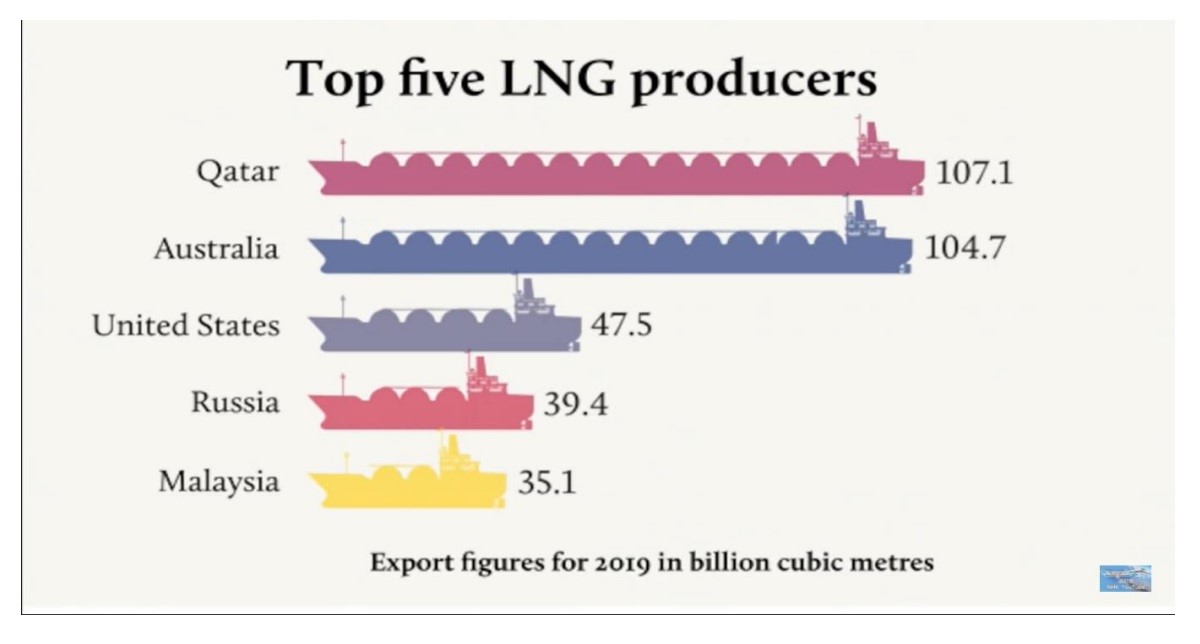

In the following chart, even Stochastic Slow and MACD could not give a buying signal on Dec 1, they gave out a few days after that anyway, later than the writer.

Figure (vi) Coca Cola

The background is that Omicron started its spread in Oct 2021, at first not so serious. UK is the first country that imposes effective vaccine on Dec 2020, and in Dec 2021 already one year and generated enough antibody for Herd Immunity of severe illness. The vaccine is unable to protect them from infection and only can protect from severe illness. On Nov 30, 2021, mask order again re-imposed in a lot of western countries. It can been seen the KO had a great drop with large volume of transaction which means seller are very much and keen to leave the market.

Fear not, Christmas is drawing near and Thanksgiving just passed away and proven a promising future. In Dec, Christmas carol singing and family gathering carried on as usual. Actually, in 2020, people had high hopes of softening pandemic measurements but disappointed. This year they have reason to believe recovery is on the way, and booster jab gives them more confidence. They understand even the transmission of Omicron is in wider spread but the hospitalization and detrimental rate is goes lower and lower. They have strong reason to believe recovery is on the way.

In Jan, Ukraine crisis grew tightened, at first few people would believe in a real war, may be just words and no action. But later when it broke out, people would think it can be finished in a few days, as it lasted longer, it really led to a drop in most stocks. However people are still quite optimistic in recovery. The writer again suggested a new round of buying on KO and MCD before Easter holidays.

In Dec 2021, there were still mask orders in public transport. But in late January, Downing Street already said they are considering at what time will cut the pandemic measurement. On Feb 9, 2022. Boris Johnson announced that with effective on Feb 24, the UK will cut all pandemic measures and goes back to normal. But people cannot wait, on Feb 11, the writer shown photo taken on previous day (Feb 10) in the open market of Waterloo, London, nearly all people put off their mask and even poster ask them to show their smile by a tooth care advertisement. But just one day ahead of the announcement, the writer already recommended investors to buy the BA, and the scenario is turning better and beams of hope can be seen. Henceforward, different countries follow UK to cut the measurements step by step according to their local situation.

Figure (vii) Advertisement in open market (UK)

Ultimately, even after the fall in May, KO and MCD had a great V-shape rebound which are stronger than the rebound of other V-shape stocks and 3 major indices, which proved the recovery power of these two can persist longer than others. This is what individual investors want, find some stock stronger than the indexes and other stocks. For further details, please refer to The Express of Feb 11 and May 31, 2022.

(ii) Travelling Stocks

At the same time of early Feb, even Ukraine crisis broke out. The writer asked investor not to buy new stock until the end of Feb, just to observe further for the development. For China would hold the Winter Olympics in Beijing from Feb 4 – 20, intelligence said China do not want Russia to start any military action before the end of the Winter Olympics. China had spent a lot of money and energy to run the Games, but the west had sanction upon it, and already made China disappointed. If a fighting is started by Russia, then most of the news will report the conflict more than the Games. So Russia really postponed the conflict until the end of the Games. So in such a case, first of all, must get enough information. Secondly when you get the information, must also analyze whether those information are correct or wrong, true or false.

On Feb 23, just one day ahead of the bottom, the writer said can buy by the end of Feb which is 28th and said recovery will come in late Mar for it will be a season of travelling for Easter and when hot weather comes, Omicron would be easier to control. Market really reached bottom on Feb 24 and in late Mar Manchester Airport was overloaded for several weeks. In late Apr, it was the overloading of Toronto Airport. In May, Birmingham Airport were also overloaded and other smaller airports are congested one by one including Bristol of the UK. Actually, airline industry has a big bloom. But the writer already suggested to buy the airline stocks like AAL on Jan 19, 2022.

Figure (viii) Delta Air Lines

Please refer to The Express of Mar 31, 2022, the writer started to recommend Delta Airlines (DAL) and said it would replace Delta variant of Coronavirus. In Apr 12, just before Easter, still continue to recommend several times for airline stocks, like DAL, UAL, AAL, LUV, RYAAY, SAVE and BA.

(i) Military stocks

The American stock market affects the world market, and in turn everything happening under the sun would affect the US stock market no matter in which continent of the earth. There are numerous wars on earth, but some of the effects would re-occur, some never. Market analysis is to find out what will come next according the so many wars in the past, no matter it is called fighting, conflict, military action or war, just simply group together to discuss. Anyway, we have to understand everything which is inter-related and cannot be cut off anything.

Whenever a war comes, military stocks will be benefited. But mind that it only occurs in early stage, or the stocks already started to rise in pre-war stage. The impact is great, but fast up and fast down. That is when the crisis is over, it will go back to original position. Of course when the market is in uptrend the bloom will last longer, but when in downtrend, the drop also will be faster. But for core product companies, even there is an avalanche in the market, the drop will be limited. Let’s have a review one by one according to The Express one by one.

Jan 6, 2022: The year of military drills is at its peak in 2021 but in 2022 seems larger, but the focus changed from against China to against Russia. The crisis in Kazakhstan was put down in just a few days, and henceforward the crisis in Ukraine replaced all others. The writer recommended LMT, ATRO, BA, RTX, GD and NOC.

Jan 26, 2022: Just before the FOMC meeting, the Ukraine crisis grew more severe, the writer recommended LMT, RTX and GD.

Feb 8, 2022: RTX and GD on record high, continue to recommend LMT, BA, RTX and GD.

Feb 10, 2022: Suggested stop buying new products because of war crisis. Feb 22, 2022: Said stop short selling and buy around Feb 28.

Feb 23, 2022: Said if war starts now, bottom is not far away.

Feb 24, 2022: Military Action of Russia to Ukraine started and confirmed that is the bottom of the market because of reverse trading, just 2 trading days form the forecast of The Express of Feb 28.

Mar 7, 2022: Since a lot of military stocks gone up and on record high, people dare not to chase, the writer recommended NOC, at length it proved can stand fast in the avalanche of May.

Mar 24, 2022: Again recommended NOC for it is in Wave 3.

Mar 30, 2022: Disclosed the PIN code of US nuclear black box.

May 6, 2022: Russia deployed nuclear shooting platform to Baltic Sea, US deployed Eye of Battlefield manufactured by NOC to Latvia. DJIA fell 1063 points.

May 10, 2022: Quoted The Divine Comedy: “Abandon ye all hope who enter, this is the gate of Hell”. The market started to drop.

Figure (xix) LMT

No matter the purchase is done in Jan or Feb, there are plenty of room for prices to rise. After the military action of Russia started in Ukraine by the end of Feb, prices rocketed up high. In early Mar, people know the fighting will be a long term fighting so the importance is weakened and price stopped to rise also. But later on, western countries promised to supply more weapons and price again rise. On Apr 8, Russian troops withdrew from Kyiv, and started a new round of peace talks for two weeks, price started to fall with the market. In May even there is a crash in 3 indices, the LMT only fell a little, because there will be a grand counter attack of Ukraine in Aug up to one million people after training of using new weapons. Small scale counter attack will start in mid Jun. LMT is the largest military contractor of the world and leader in 5th generation stealth fighters, but they won’t sent stealth fighters to Ukraine, so investor have to know what kind of weapons are sent and manufactured by whom.

The following is a comparison of RTX and NASDAQ, the RTX keep on rising while NASDAQ is following, even when falls the magnitude is quite little.

Figure (x) RTX and NASDAQ

Figure (xi) NOC and Dow Jones

When purchased in early Jan as recommended, even after the avalanche of Dow Jones in May, still get a certain profit. It still rose on the day where DJIA fell 1063 points.

Figure (xii) GD and S&P

All the way, the performance of GD is better than S&P, that is the target of most investors, try to find a stock better than the 3 major indices.

(ii) Nuclear War

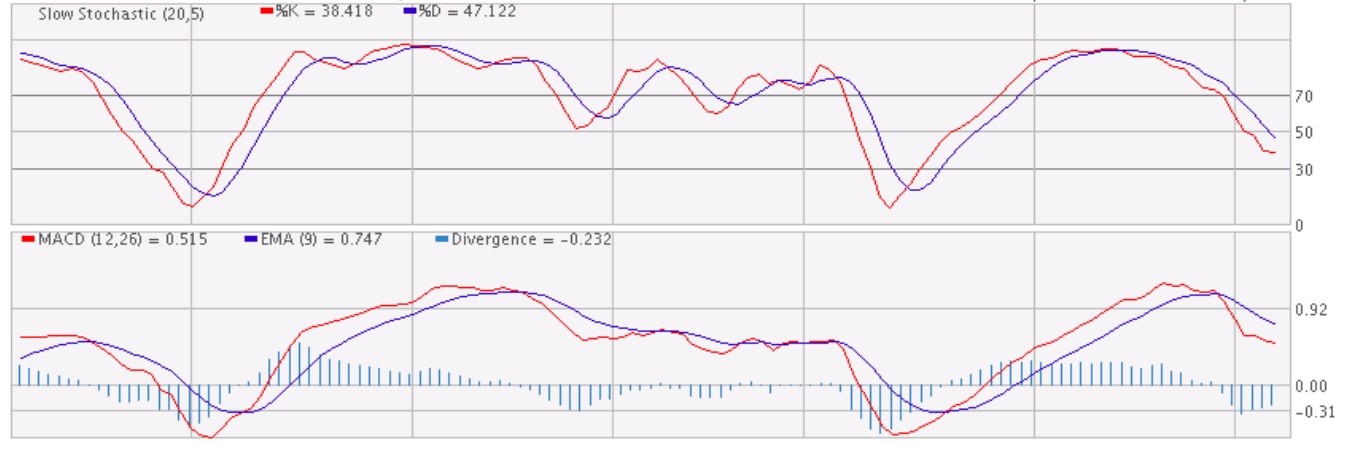

The writer wants to make clear two concepts here, a lot of people misunderstand the function of the nuclear black box or nuclear briefcase. They thought that the nuclear black box has a remote control button, and when the president enters the PIN code and press the button, the nuclear rocket will shoot at once. No! No! No! Russia has 5977 and US has 5428 nuclear warheads, they are not shot by the president, but the Commander-in-Chief of each military site. There are two black boxes, one is containing maps of nuclear site, showing the president should use which site and contact that commander. The PIN code is for turning on the computer in another black box, so as to get in contact with that commander, when nuclear button is pressed, that designated military site will sound out an alarm. It actually is an alarm telling everyone must stand by in their own position at once and keep high alert, for nuclear war is going to burst out. Nuclear shooting sites cover mainland of US and oversea military sites, including submarine and Doomsday Warplane. So when alarm sounds, they can react at once. When receiving the call of president, they know that it is not a misdialing but a serious matter. So investor need not afraid if a president is infected with Alzheimer’s Disease or Parkinson’s Disease would wrongly press the button to shoot out the nuclear warhead. When the Commander-in-Chief is in suspect the mental state of the president is not stable, he has the right and responsibility to double check before shooting. When the capital is attacked by nuclear bomb, do not afraid, Doomsday Warplane can carry out retaliation to destroy the enemy and their allies and the whole earth. Refer to Mar 4, 2022 of The Express please.

Figure (xiii) Doomsday warplane

Secondly, people asked me to forecast if there will be a nuclear war or not. It is no need to do so. For when the answer is negative, then everything will carry on as usual. When nuclear war is broken out, all lives on land and sea and sky will be destroyed. Only cockroach can prove you are correct. Please refer to The Express on Mar 30, 2022.

(iii) Focus on energy

In late 2021, even a new wave of Coronavirus burst out, but confirmed the detrimental rate is quite low even the spread is faster and wider. Therefore if large amount of troops gathered together, no need to worry of the pandemic. It is said that in later Aug 2021, when the withdrawal of US troops was in a mess, Putin had already prepared for the military action. So what is the impact on market? —– Petroleum, natural gas and energy stocks!

Russia needs the support of China, what kind of support? Keyboard fighters (Big Foreign Propaganda) to speak for Russia that they are correct and US and the west are devils. China would not support arms directly or else they would be sanctioned also. Please refer to The Express of Jan 20, 2022, the writer already suggested to buy energy stocks like BP and CVX, Why? The news of that day confirmed the peak of Omicron had already passed, which is a green light to military action.

Figure (xiv) Chevron Corporation

There are two items of news on the same day worth quoting: Omicron

The United Kingdom is considering easing the epidemic prevention measures in England. Health Minister Javid said in Parliament earlier that he believed that the number of confirmed cases and hospital admissions had passed the peak period, and he was optimistic that the measures could be relaxed next week.

Jan 20, 2022

Ukraine

U.S. Secretary of State Blinken arrived in Ukraine to visit, Blinken said that Russia may deploy more military forces in a short period of time to launch an attack on Ukraine, Washington will continue to use diplomatic efforts to prevent aggression, promote dialogue and peace, and call on Russian President Putin to choose a peaceful way to deal with the Ukrainian issue.

Jan 20, 2022

Such kind of news can be seen easily, but during that period it may be a road to war because on the previous day Blinken had arrived EU to talk with them on sanction of Russia. Therefore news cannot be just cut off and read a one day news must carry on consecutive. A smart investor must keep full record of the news of special topics.

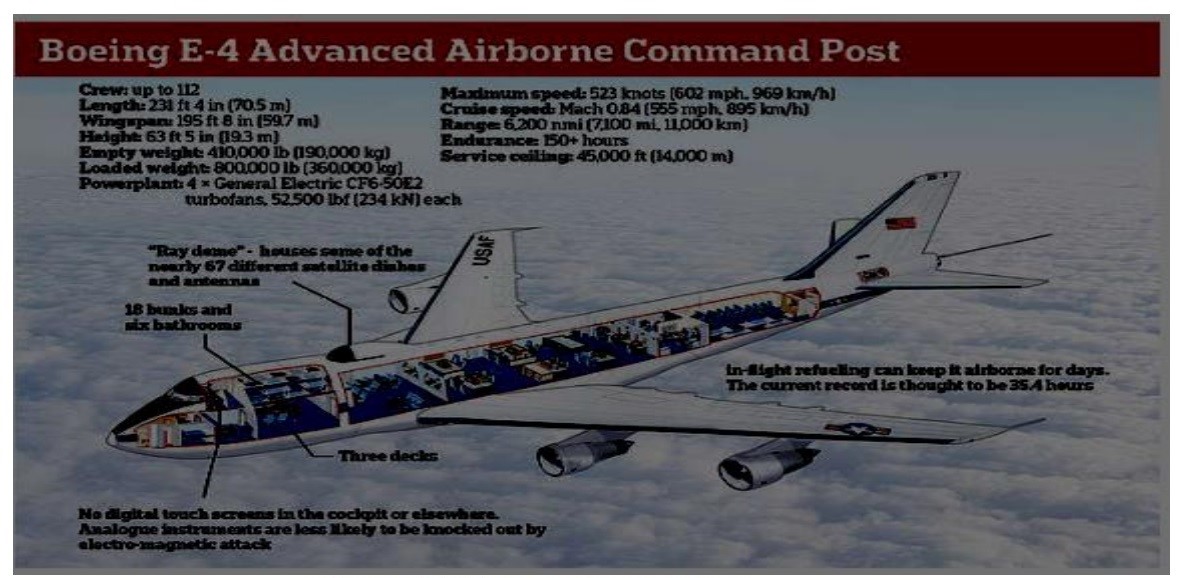

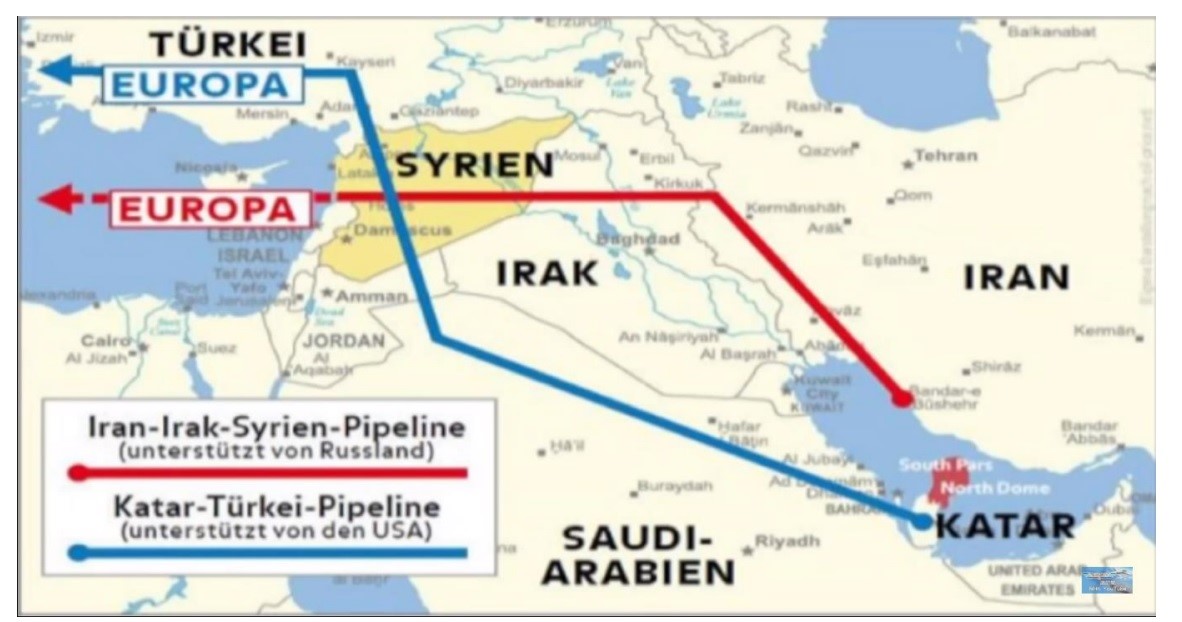

On Feb 3, 2020, there is a special page on the Gas Pipeline of Qatar to Europe, it was fixed by Joe Biden and Al-Thani Emir, King of Qatar in White House, noticing the importance of energy. Meanwhile Putin flied to Beijing for Winter Olympics.

Figure (xv) Liquefied Natural Gas Producers

Figure (xvi) Proposed Qatar Pipeline

(iv) Winter Olympics

On Feb 4, Putin attended the opening ceremony of Winter Olympics in Beijing. China has high hopes in the Games hope to show it is superior to others. Western countries have sanction on China for the opening ceremony and do not sent any official to attend. However, all athletes will turn up for competition as usual. Russia disclosed to China they would start a military action against Ukraine, China requested them to put it after the Olympics, or else every news headline will be on the war and the Olympics Games will lost it glamor.

(v) Reverse Trading on war

On Feb 8, The Express started a series of recommendation on military stocks, such as LMT, RTX, GD, BA. Also noticed Reverse Trading will re-occur this time in the Ukraine. That is in 2003 the war against Iraq, before that the crisis already started long ago, stock dropped and gold rose for half a year. On the inauguration of war, all bad news eliminated and no more bad news would come. US stock rose sharply and gold fell greatly. The job of market analyst is to find out at what time the market will go standard and at what time will go for reverse trading.

On Feb 10, The Express talked about nuclear war, and the atomic cannon of Russia. The writer asked investors stop buying new product till the end Olympics.

Feb 17, after telling people not to buy new product the market dropped for one whole week. Both gold and energy (petroleum) went up.

There was a drop in FB on Feb 3, a lot of people wish to buy at low, but on Feb 18, even if dropped further, the writer said the buying time not yet come because of the crisis of a war.

Feb 22 Beijing Olympics ended, the writer said still not yet the time to buy, should buy around Feb 28.

Feb 23, the writer said bottom fishing started, that is the bottom is near

Feb 24 Military Action on Ukraine started, the writer asked in the Heading “Will History reappears itself?”

Feb 25 Confirmed History really re-appears the Reverse Trading this time on inauguration of was that Gold price fell under 1900, Petroleum fell under 100. Confirmed on inauguration of war, even at first was panic selling but soon went up, Dow Jones in Doji style, S&P in rising hammer, Shortly after New Year, the Ukraine crisis grew faster and faster and the writer suggested to buy BRK.B and it rose from early Jan till Apr, and re-iterate to buy BRK.B on Jan 31.Anyway investor has to refer to The Express of the above dates.

(a) Forecast on Index

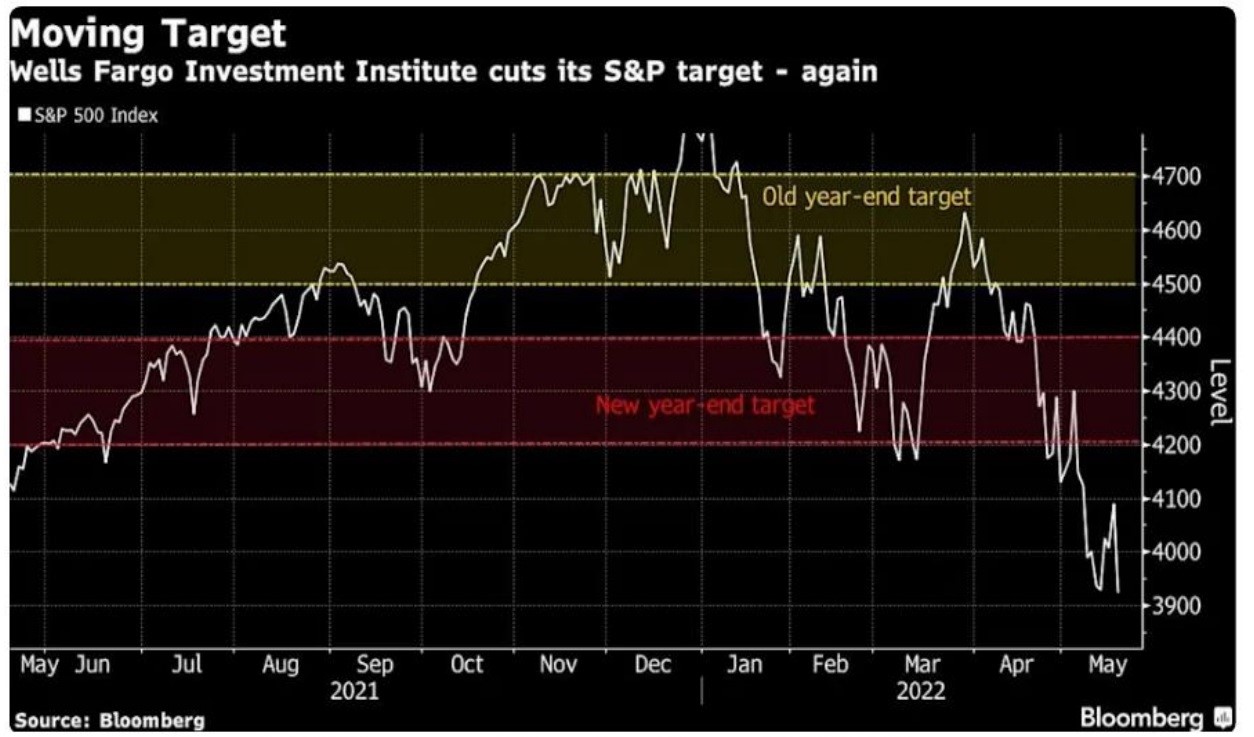

In the beginning of every year, normally a lot of Think Tanks or Investment Banks will have forecast on the market, mind that some of them would adjust in the middle and some would not. Figure (xvii) is the original forecast for 2022.

Figure (xvii) Forecast of S&P for 2022 In Dec 31, 2021, the closing price of S&P is 4785

Figure (xviii) Upper zone is the original forecast of Wells Fargo, Lower zone is the adjustment after the stock crash.

(b) Forecast On Interest

Even the cycle of interest rate increasing started in Mar 2022, but it has been talked about for more than a year, and on the time of writing this handout, the interest rate of major central banks are:

Major Central Bank Rates

| Country | Rate | Change | Date |

| US | 0.75% – 1.00% | +0.50 | 2022/05/04 |

| EU | 0.00% | -0.05 | 2016/03/16 |

| Japan | 0.00% | -0.10 | 2016/02/01 |

| UK | 1.00% | +0.25 | 2022/05/05 |

| Australia | 0.10% | -0.15 | 2020/11/03 |

| NZ | 1.00% | +0.25 | 2022/02/23 |

| Canada | +0.50 | +0.50 | 2022/03/03 |

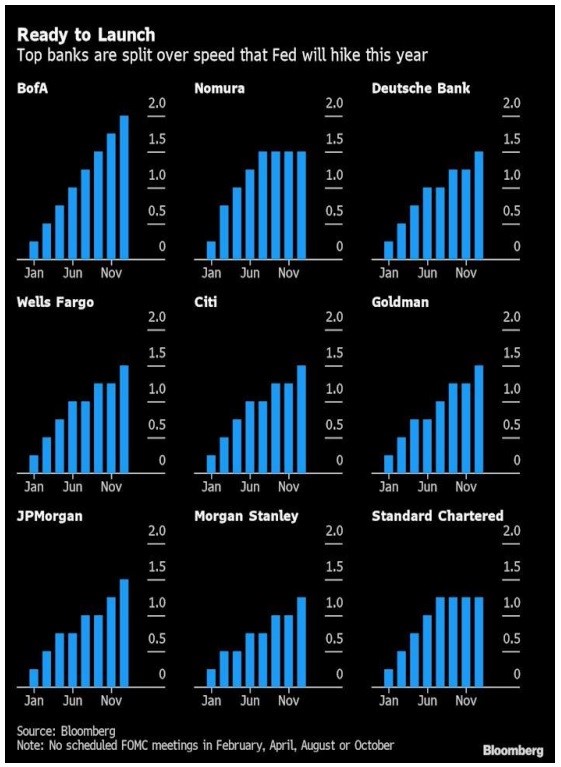

The attached Figure (xix) is forecast of 9 major banks of S&P in 2022, it is done after the FOMC meeting of Jan 25-26 and released by Bloomberg on Feb 1, 2022. Mind that sometimes they would have adjustment in midyear and sometimes not.

Mind that when this table is complied, the interest rate of US is at 0.00-0.25%. It is shown as in the first bar of Jan of the chart. We can see every bank starts at the same position. The arrangement of the chart is that the top left is the highest forecast and read horizontally for decreasing of forecasts, for first line and then second also reads from left to right is the highest to lowest and then third line, the lowest is on bottom right.

That means the forecast of Bank of America is the highest and Standard Charter is the lowest, the last bar of Standard and Chartered should be read as 1.25-1.50%.

This year is a year of rate increasing, so concerning interest rate must be kept in good record, besides the tables in Allocution 10, one more point should mind. In the beginning of every year, there are a lot of forecasts, but normally investor just gone through it and forget everything.

Figure (xix) Adjustment in mid-year of Wells Fargo

(a) Buy on falling

Investors of Stock Market normally like to buy up than short selling. The basic theory is that when buying up the profit is unlimited and the lost is just limited to ground zero. But for short selling, in turn the profit is limited, but the loss is unlimited. Sometimes it only happens on certain individual stocks. Therefore, even the market is falling still a lot of people want to buy.

So if it is for stocks of actual power, can buy at any time, if it rises sharply, take profit at once, or else hold it for 10 years you will have unexpected profit. The writer told investor to buy AAPL on Mar 15, 2022, which is the bottom of a wave, so investor can take it for short term or long term purpose.

Figure (xx) Apple

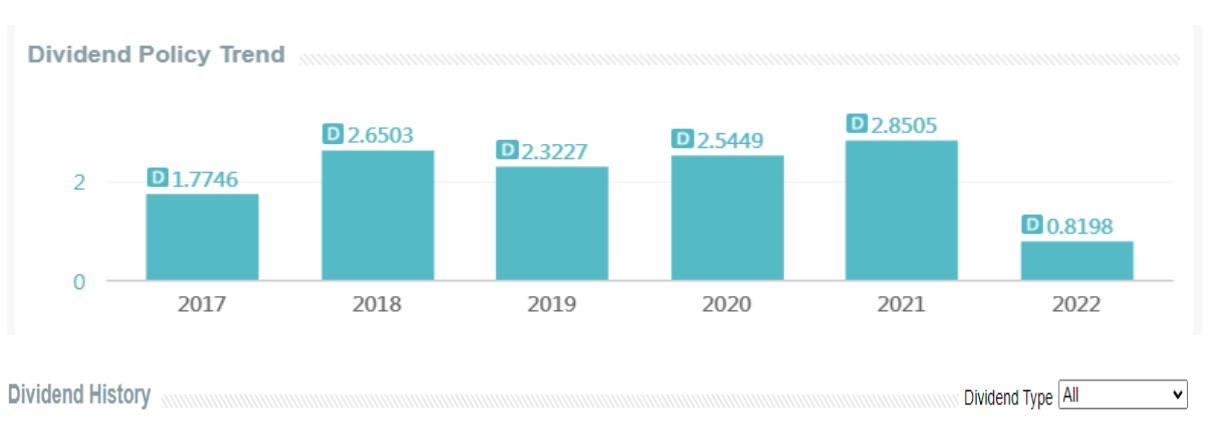

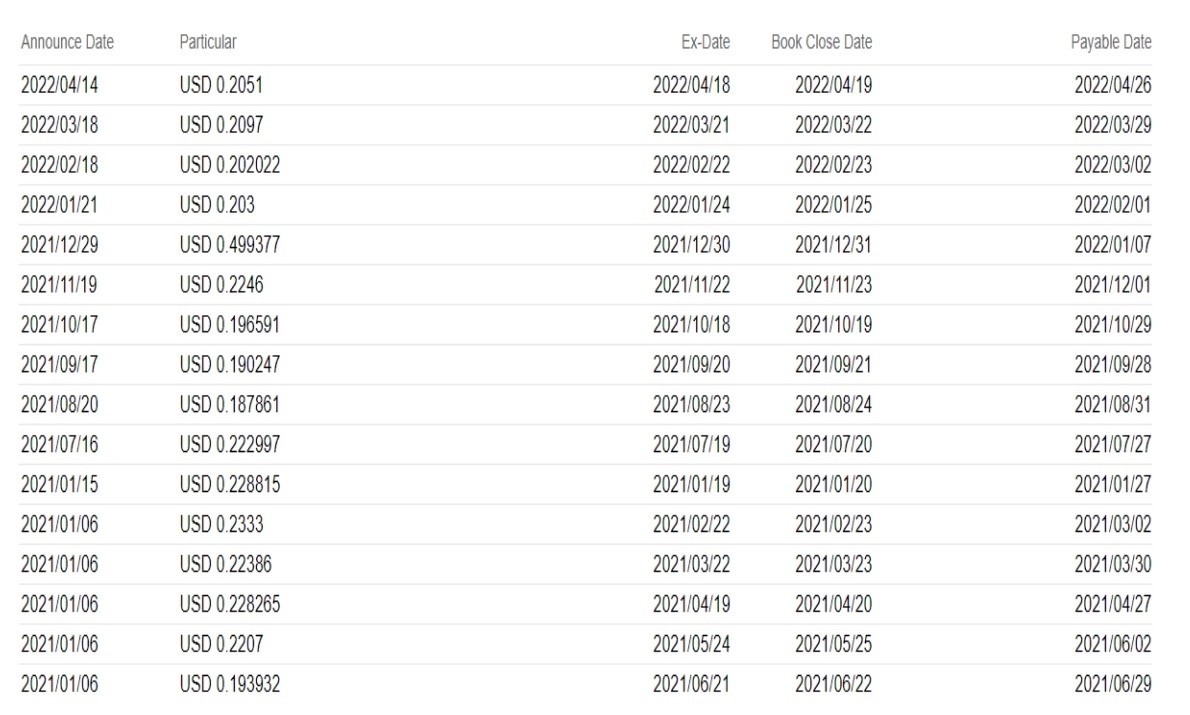

And if for longer term purpose can buy the QYLD, as said on May 11, 2022 so as to take the dividend—–

So those whosoever wish to buy at low can consider QYLD no matter the bottom has reached or not. Even if the rebound come slower, it does matter, the dividend on the average is 20 cents per month which is $2.4 per year. Previous closing is $18.6, it means after seven and a half year you can earn back all your capital through dividend and what left in your account is a total profit. So you can choose to sell at any time or do not sell it until it…….

Figure (xxi) Dividends of QYLD

(b) Buy Inverse Trading ETF

In order to lower the risk of short selling, investor can buy the Inverse Trading ETF such as SQQQ, PSQ, QID. It’s very simple that SQQQ is the reverse of QQQ or going in opposite direction with NASDAQ. When you think NASDAQ would fall, just buy SQQQ and you can earn a lot. Just treat it as simple as an ETF or other stock. The greatest risk is at most you only would loss all you money invested in this stock, while the other capital inside your stock account will not be affected. But if you really do short selling in the market, your loss is unlimited, not only you can loss all you capital inside your account including the investment in other stocks, but also your responsibility is unlimited. That means you have the chance to loss all your money earn in the past and future for the whole life. Even it may only happen once or twice in a decade. But investing in Inverse trading ETF can eliminate such a risk, but you can still do the short selling through the ETF. So please treat short selling meticulously as they are for professional investors and get a comparison of these ETFs and NASDAQ.

Figure (xxii) SQQQ and NASDAQ

(c) From Adjustment to Bear Market

According to Dow’s Wave, during Stage I of Bear Market the sentiment is still very optimistic. The drop is just considered as a slight adjustment of Bull market, it may be caused by profit taking or worrying over long term factors. Stage II normally has a strong rebound but cannot go back to original position, some people are still waiting for the price to go up, but some confirmed the advent of Bear Market like this bulletin announced on May 10, 2022. In such a critical juncture, just a normal description is not enough, so the writer quote the Divine Comedy from Dante as the Heading:—–

Abandon ye all hope who enter, this is the gate of Hell.

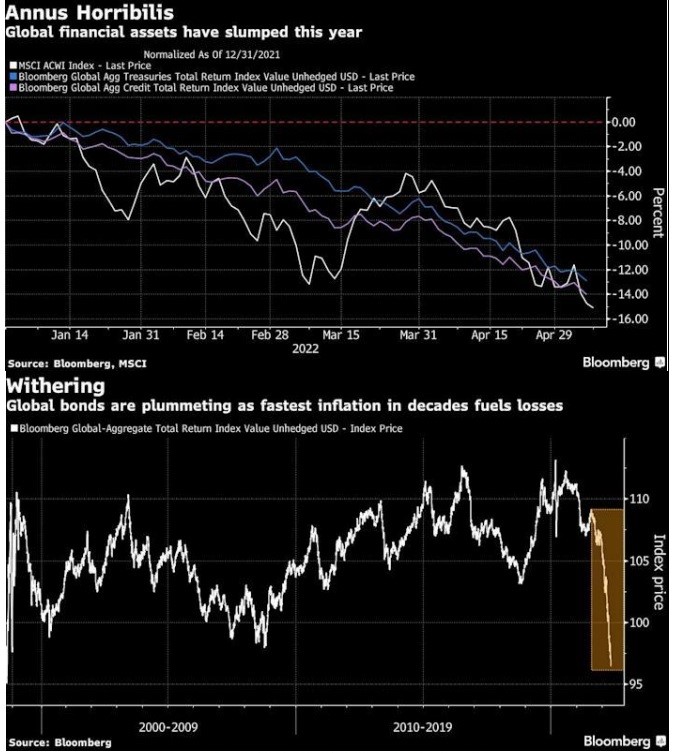

Even just quoted data from stock market is not enough, in order to show the comprehensive trend of the economy; The Express also shown All Country World Index (MSCI-ACWI) already fallen under the previous support and global bonds also. Normally The Express has 5 pages per day, but on that day is of 8 pages, just to show that is different from other days.

Figure (xxiii) Financial Assets & Bonds

Bear Market is not a sentimental description, but a financial definition. There are several definitions of Bear Market, let’s go through them one by one. As for Bull Market, just simply make it vice versa.

(i) Penetration of year line

Every year has 52 weeks, when cutting off holidays will be about 50, and each week has 5 trading days. Therefore 5 x 50 = 250, so the yearly line should use 250-day will be more logical. But in the financial market, when everyone is wrong, it is right. In US, they accustomed to use 200-day line, for investors are so keen to know the result concerning breakthrough and want to have an earlier decision. So which one should we follow? It differs form time to time. Traditionally, it is the 200-day line, but since the participants are more and having more variants, in recent years people tend to refer to 250-day line. We actually have to refer to both and see which suits the current situation. Oh, not yet finished!!!!

There are 12 kinds of average lines in the NetDania chart, including (1) Adaptive Moving Average, (2) Displaced Moving Average, (3) Exponential Moving Average, (4) Gaussian Moving Average, (5) Hull Moving Average, (6) Kaufman Adaptive Moving Average, (7) Modified Moving Average, (8) Normalized Moving Average, (9) Pivot Point Moving Average, (10) Simple Moving Average, (11) Triangle Moving Average and (12) Weighted Moving Average. Will discuss these further in advanced course.

People may ask which is the best or most accurate. If there is such an answer, all others will be eliminated from earth and why they can still exist? That means they have their function not yet detected. A more appropriate question is which suits the current situation best? This wave is that and another wave is another line. Or another question is which suits beginners and which suits advanced investors?

Anyway, we have to pick up 1 or 2 for using. For the current wave, current situation, and current drop, better use 2 out of 10 for beginners, which are Simple Moving Average (SMA) and Weighted Moving Average (WMA), each should use both 200-day and 250-day line. That is 2 x 2 = 4 lines. But it is only one of the definitions of averages lines, we still have other definitions on detecting Bear Market, we still have a lot of technical indicators and economic indicators. We also have elementary level and medium and advance level to discuss. Above all, international happenings cannot have so many definitions to decide which war is important or unimportant…. and which policy….. which meeting….. which agreement.

The learning of investment equals to a degree course in a university and not just raises a question and the other side gives you an answer and will be completed. Mind that even something a university course cannot provide, that is experience.

(ii) Turning down of year line

Figure (xxiv) DJIA 250-SMA turned Bearish on top

DJIA is a typical example of Bear Market Penetration on Apr 21, 2022. That day is the top of a Double Top, so normally when match with other patterns of indicators will be more accurate. Mind that on that day you would not know it’s the highest, you can only know on the next day when it plunge into the Ichimoku cloud, we call it confirmation. That is Stage II of Dow’s Wave finished and started Stage III of Bear Market.

Figure (xxv) S&P 250-SMA turned Bearish on bottom

The turning point this time is at bottom, just in contrast with the DJIA. S&P reached the Double Bottom and lingered for a while and then penetrated downward. Mind that the big black candlestick is on May 9, Victory Day of Russia. Because of difference in time zone, Putin has already finished the Military Parade without declaration of war. If a large scale war started at once, no matter who is the winner or loser, it will be clear very soon, but now means the war will be prolonged at least to the end of this year. Therefore chart analysis is not all in all, it has to cope with international happenings.

Mind that it is a pattern of Parallelogram, that is a complex pattern of Double Top and Double Bottom, the 250-SMA of S&P turned from rising to falling on May 9, but it is only confirmed after market closing. Therefore on May 10, The Express use the Heading as

Abandon ye all hope who enter, this is the gate of Hell

Figure (xxvi) NASDAQ turned down on the same day with DJIA

Prior to this, NASDAQ 100 also had its 250-SMA reached top on Apr 21, the same day of Dow Jones, but NASDAQ is not on the top, it dropped through the bottom of Ichimoku Cloud, but it is still in the middle of the Parallelogram (A)(C),(B)(D). On penetration of S&P it has already dropped under the Parallelogram, therefore when 3 major indices all confirmed turned weak. It is the time to pronounce Abandon ye all hope who enter, this is the gate of Hell. Market is at its low, but we do not know it is of L-shape of Spade shape, both has a long period at low, the former drops quickly and is known as L-shape, latter drops slowly and known a spade shape. So after confirmed dropping, people are waiting for a rebound, would it be a strong or weak rebound? For Parallelogram, please refer to May 25, 2022 of The Express.

All the way, NASDAQ leads the rise of these two years, as well as the fall is led by NASDAQ. But inside the index, it is led by AAPL and TSLA also, so we better refer to them. Both stocks has a rising 250-SMA even the 3 major indices are having great fall. So we can still wait for a strong rebound until the 250-SMA of AAPL and TSLA both turned down.

Figure (xxvii) AAPL and TSLA are leading the NASDAQ, Both of the 250-SMA are still rising even the 3 major indices turned down

(3) 20% drop from the high

Even though this definition is more commonly used then previous two, but neither can be neglected. The drop of NASDAQ 100 of 20% from high is 13416, already penetrated long ago. Mind that there are 2 NASDAQ indexes, NASDAQ composite index tracks all the companies listed on the NASDAQ Exchange House, the NASDAQ 100 follows only the top 100 companies with the largest market capital that are listed on the NASDAQ.

Figure (xviii) Watershed of NASDAQ 100 Since it reached Double Bottom and MACD shown sign of turning point, still can buy AAPL and later airline stocks for Easter. The closing price of NASDAQ Composite (IXIC) on May 27, 2022 is 12,131.13 +390.48 (+3.33%); while for NASDAQ 100 (NDX) is 12681.42 +404.63 (+3.30%). NASDAQ 100 is sometime called “US Tech 100”.

Figure (xix) Watershed of S&P

S&P had a false penetration of watershed, that is dropped under it in intraday trading but closed above it.

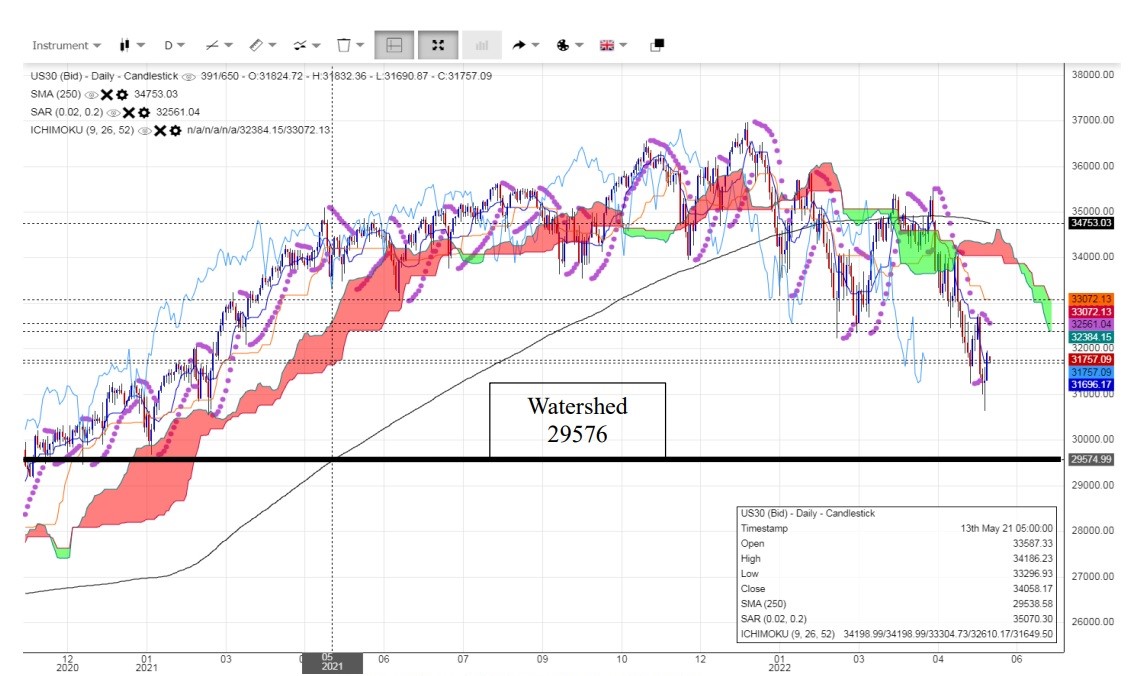

Figure (xxx) Watershed of DJIA

Even the 250-SMA has turned from rising to falling, but it is still far away from the watershed of 29576. That means the risk of falling under the watershed is not so great. The low goes back to the low of Mar 2021. That is shortly after Joe Biden took office and western countries furiously on the way of inoculation.

But now, it’s by the end of pandemic. A lot of countries would not mention any more concerning it and attention of general public are of refuges of Ukraine and stagflation. For the relation between the watershed and Fibonacci series, please refer to The Express of May 27, 2022.

On May 12, 2022. Three major indices had all dropped under the Parallelogram or under the previous support. The previous low of S&P on May 11 was 3929, and the Bear Market Watershed of S&P is on 3856, which would be likely to test it on May 12. The market seemed in a state of oversold for every barrier had already penetrated. Investors are keen to know just one point. Whether the market would continue to fall or rebound at that level. The writer used Elliot Wave to prove it’s not the end, the topic of Market Observation on May 12, 2022 is “Wave 5 is extending”.

Please refer to Figure (xvii) the Wave 5 of NASDAQ 100 and Wave 5 of S&P, please also refer to the Sudden Test on May 13, 2022. This time is talking on Elliot Wave only, while in the advanced course, the writer will talk further on Gann Wave, Dow’s Wave, Neo Wave and Wolfe Wave…….

Figure (xxxi) the Wave 5 of NASDAQ 100 and Wave 5 of S&P

Nowadays is a world of globalization, that means everything in the market or outside the market is inter-related and cannot be cut off. Therefore, trading in US stock market must also mind the other markets such as currency, gold, futures, crypto, and energy. Also everything happens under the sun including pandemic, environmental protection, political and cultural background. The essence of market analysis is to go deep into current conditions so as to grasp it future trend of development and see how it affects the market.

Market analysis is different from prophecy even though sometimes similar, but the point is to grasp hold the trend of happening so as to have a better investment plan.

(a) Ukraine

(i) The writer used the experience of the War of Iraq in 2003, and expressed there is a chance of Reverse Trading in the first day of war, and it really re-happened. Before the fighting started, stocks went down gold went up; after the inauguration day, it’s the vice versa, stock would not fall again but went up and gold not up but down. I advised investor stopped buying new products till the end of Feb. There are a lot of wars in the past; we have to analysis which will re-occur and which will not.

(ii) During the initial stage of fighting, Russia expected to finish the fighting in 48 hours and establish a temporary government in 72 hours. The west would also think it would be finished soon and even arranged the president of Ukraine to fly to Poland. But the fight persisted on and president did not left. On the 7th day several countries approved to supply weapons to Ukraine and 10th day first group of weapons arrived. That means on the first 10 days Ukraine fought on their own. On the 11th day, The Express said the fighting will be a long term fighting and will last for months and not just days or weeks. But on the 21st day, the Ukraine president said the fighting would be of a long term, 10 days later than The Express.So if you know that it is of long term, it means it would affect stagflation together with the pandemic in China.

(b) Pandemic

On 18th and 22nd Feb 2022, The Express shown the emergency wards in Hong Kong were congested and as poor as Les Miserable, and asked what made Hong Kong turned from Paradise to Hell in contrast with London. Later Omicron burst in northern cities of China. In late March, Shanghai was locked down, at first only expected for 4 days later two months. Already said even infected people can move out of Shanghai, how about other cities? Shanghai can be cleared easily, but surely would overflow to other cities. Anyway, the pandemic will pass away somehow, but would affect the production chain to a great extent, which in turn deepens stagflation.

(c) Petroleum Crisis

Petroleum affects the economy of modern society very much. The crisis started in 1973. In the Bullion Express, I forecasted it would end in Jan and Feb of 2016 at the price between US$22 – 28. Ultimately, petroleum really reached $27.55 in Jan and $26.06 in Feb to form a Double Bottom. So thus ended the petroleum crisis which started in 1973 and lasted for nearly half a century. Actually, it affected every part of the financial market.

(d) Turning point of gold

By the end of 2015 and early 2016, I forecasted the turning point of gold market in The Bullion Express and the accuracy is up to the year, month, day, hour, minute and second. In order solve the petroleum crisis, US had been developing Shale Oil for years, and announced successful in 2012. And in 2015, US will become the largest producer of oil even greater than Saudi Arabia. At the time the cost is $120 but the current oil price is $110. It won’t have great help but at least can press the price not above that level. But later on, as they developed further, they proved they were really talented people and lowered the cost from $120 to 110, 100, 90, 80, 70, 60, 50, 40, 30, 20….in just one year’s time. Gold price fell together, in Nov 2015, even there is a terror attack in Paris that the French president was in the same stadium watching soccer match, the price of gold did not rise and continued to fall.

The Bullion Express forecasted the end of falling wave was on Dec 31, 2015 at 24 hours, and then the rising wave will start on the 1st month, 1st day, 1st hour 1st minute, 1st second of 2016, and it really did. Actually gold price go in coincidentally with oil price.

(e) Stock price

After the Financial Tsunami of 2008, Barrack Obama took office in Jan 2009 and passed a bailout of ARRA of $787 Billion to save the economy. On Mar 6 (Fri) 2009, White House announced that the first tax refund check of the ARRA had mailed out. The writer told investor to mind this check, for it is very, very, very, very important, for it would bloom retail industry and is considered as the first practical way of recovery. Later it proved it’s the starting point of Bull Market of Dow Jones which is at 6470 and carried forth for 13 years till now (2022).

In 2016, the DJIA opened at 17,554, the writer said it would had a great rise but could not over 20,000 points. By the end of Dec it tested for 4 times, the highest point was miraculously at 19,999 and retreated. Until late Jan Donald Trump took office it broke the record high and above 20,000 points till now is still over it.

In 2017, the forecast of that year was “Wide, Wide as the Ocean, High, High as the Sky”. Dow Jones made 71 record highs, the most in history. On the average one record high in every 3.5 days.

In 2018, the yearly forecast was “Higher than Apex”. Continuing the apex of previous year, it was really higher. S&P established the longest Bull Market in US history.

All the above were shown in The Bullion Express for it is a world of globalization.

(f) News reading

On reading news, must react at once and understand the relation of every sector and also in continuation of previous news.

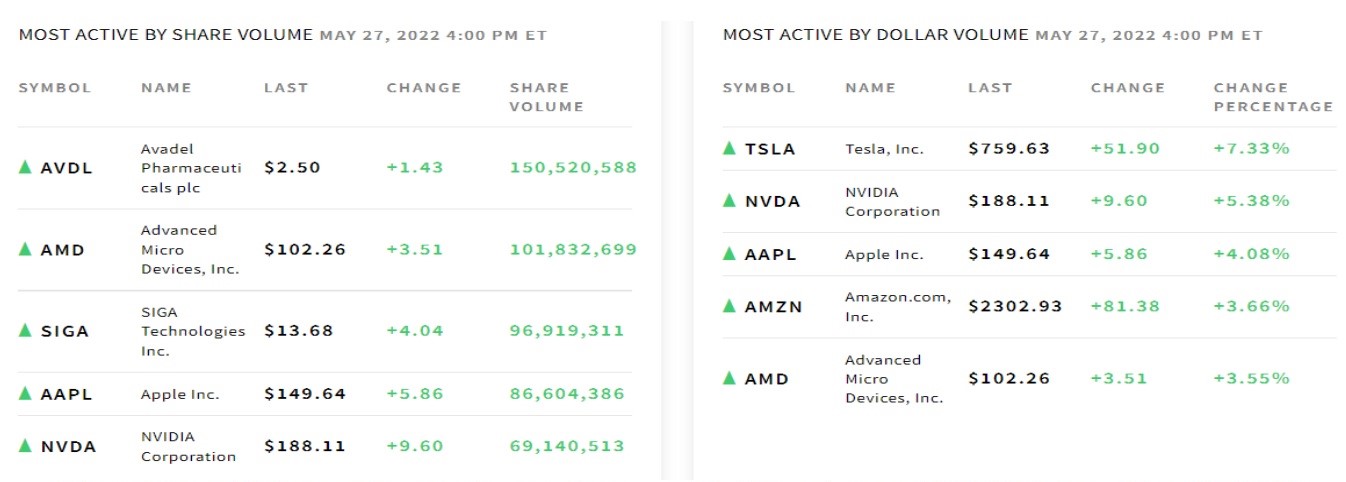

On May 27 (Fri) 2022, just after market opening, I released a breaking news in the Telegram group at 10:00am New York time telling the AMD will have a business with TSM, and details will be jammed in the World Observation of The Express on following day in the breaking topic of “Semiconductor”, and the original series topic of “Stock Crash of 2020/2022” will be suspended for one day and give way to this breaking news topic. Just to show this topic is important and cannot wait for the end of that topic and must jam in at once. But the Telegram group cannot explain so much, so I just asked readers to mind the related stocks of INTC, NVDA, QCOM, MSFT, AAPL, IBM, GFS, UMC, AMD, and TSM. Explanations can be seen in The Express of next trading day. On market closing, several related stocks are on the top 5 of trading either by volume or by shares in the NASDAQ.

Figure (xxxii) Most active by share volume and dollar volume of NASDAQ on May 27,2022

One thing to mind is that AAPL just announced a “bad news” on May 26 (Thu), the production of i-phone 14 will be postponed, originally should come up on Sep 13, 2022, but delayed due to blockages in supply chain of China because of lockdown of pandemic. But it rose 4.07% on May 27 (Fri) even NASDAQ rose only 3.30%. For on May 25 (Wed) The Express reported AAPL noticed contracted manufacturers to expand their production outside China. On May 23 (Mon) also reported that Vietnamese Prime Minister Pham Minh Chinh visited AAPL head quarter in California and requested them to shift the production line to Vietnam. So investors should link up all news together and cannot cut off and watch any single news. Just as that week already 4 noted worthy items on AAPL. Please refer to Figure (xxxiii) and watch the changes.

Figure (xxxiii) The last 5 bars are of date May 27, 26, 25, 24, 23 in reverse order. AAPL rose above the 10-SMA and 20-SMA, and 250-SMA is still going up.

Also once reported the Apple Glass on Mar 14, 2022; can compare with Hololens of MSFT on Jun 1, 2022 of The Express.

IBM also rose stronger than NASDAQ, for details please refer to The Express of May 31, 2022. The importance is that when reading news must be in a continuation and cannot just cut off others and read a single news, and also must refer to chart analysis. In advanced training course and our seminars we have special method to improve one’s memory so you can remember all news you have read, but not in elementary seminars.

The market is a series of happenings linking up the past, present and future. They are inter-related even a after a certain period of interval. Such as the Stock Crash of May 2022 comes from QT Policy, it actually is the aftermath of QE Policy of the Stock crash of Mar 2020. Thus it is very hard to cut off an incident from others. Details can be seen in the series of topic started on May 20, 2022 of the Express. The major task is to find out which part will re-occur and which part will not so as to act as guideline of what should do and what should not do. The world is an ever changing world.

We should also mind that the relation among various markets. Gold is always running in opposite direction with stock, but not every day and not every point. Normally when in recent record high or low, the hit rate is quite high. Energy price is in reverse proportion with stock market, that is when oil and gas prices rise, stocks will fall; but energy stocks would rise together with oil and gas prices. Please be also minded that cryptocurrency is always in same direction with NASDAQ. When USD index rises, foreign currencies would fall, and Euro also falls most for it account 57.6% of the component of USD Index. When interest rate rises, normally USD will fall and stock market will fall. Euro is always in same direction with bullion and in reverse direction with USD Index. In weak economy when USD rises it can bloom the stock market for consumes has confidence, in high levels of stock market or when in bubble economy, strong USD Index would lead to inflation and make the market fall. Anyway these are basic principles, but sometimes would have exceptions and we have to find out when to adapt and when do not adapt.

Of course, the writer’s suggestions cannot of 100% accuracy and have to face failure sooner or later. Therefore stop loss is needed. Investor better fix his own stop loss according to capital of oneself. There is no universal standard. Some people may set at 20 or 30 price tags and some 3% to 5%, actually when in ranging market and single direction market it is not the same. And in top of the market can reserve more room for stop loss, and when in low less, or in current situation some people said no need to have stop loss for the bottom is not so far away. But again, the definition of not so far away is different from everyone, some would say 5% and some 10% or 15%….Thus it need a tailor made stop loss rather than an all-in-one stop loss.

Such as when following celebrities we should know how to follow and not just blind following. When facing the fall we must have patience to wait for coming of bottom and when in rising we should lessen the positions time by time. All these are easy to understand but hard to do. In Chinese we call this KUNG FU, not that of martial art fighting, but the greatest enemy is the Ego, that is to fight with oneself, may be Music Therapy can help you to overcome so.